43000 Cy Pres Funds Presented Benefit Legal Services

NARBERTH, PENNSYLVANIA -- A class action lawsuit against a credit union over their vehicle repossession practices yielded a settlement valued at over $570,000 for Pennsylvania consumers providing cash, debt forgiveness, and credit report correction. About $43,000 remained after distribution to the class. The court approved payment of these residual funds to North Penn Legal Services, a non-profit organization providing civil legal aid to low-income residents of Northeastern Pennsylvania.

Vicky Coyle, Executive Director of North Penn Legal Services, expressed gratitude to Class Counsel Cary L. Flitter of Flitter Milz, P.C. in Montgomery County, PA. “In our efforts to provide free legal representation to the region’s disadvantaged, these funds will help further our mission to help people in non-criminal matters such as eviction from housing, discrimination, family law, and consumer protection issues.”

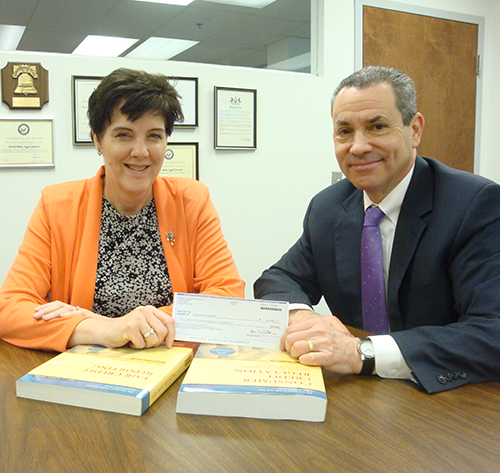

Vicky Coyle, Executive Director, North Penn Legal Services and Class Counsel, Cary L. Flitter of Flitter Milz, P.C., Narberth, PA.

Vicky Coyle, Executive Director, North Penn Legal Services and Class Counsel, Cary L. Flitter of Flitter Milz, P.C., Narberth, PA.