Was your vehicle

Repossessed?

Get Help Now!

A bank, credit union or finance company can repossess a vehicle if there’s been a default in the terms of the loan agreement you signed. A default may be the result of missed payments, late or partial payments, a lapse in auto insurance coverage, or other cause. Yet, you have legal rights, even if the lender has repossessed your vehicle.

Cary Flitter speaks about Vehicle Repossession and Your Rights

After repossession, take these steps.

Step 1: Contact your lender, or local police, to confirm that your vehicle was repossessed, and not stolen. Ask the name of the repossession towing company and the location of your vehicle.

Step 2: Gather all purchase and loan documents for your car, truck, motorcycle, boat or RV.

Step 3: Keep or obtain the Repossession Notice, or Notice of Intent to Sell Property, that the lender is required to send to the borrower after repossession.

Step 4: If the repo agent was combative in any way, write down what happened – today, while it’s fresh.

Step 5: Never sign a waiver or release agreement to get your vehicle back. Signing a waiver could give up your legal claim of wrongful actions by the lender or repo agent.

Did you have an auto loan with one of these lenders?

Borrowers have legal rights AFTER repossession.

CONTACT US TODAY for a no cost legal review.

Experienced Repossession Lawyers

Experienced Repossession Lawyers

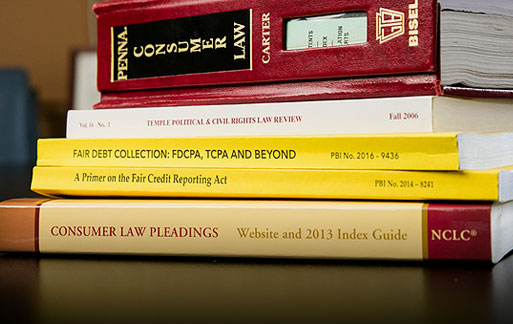

Flitter Milz has the expertise in auto repossession that few firms can offer. We have recovered tens of millions of dollars for borrowers who have become victims of wrongful repossessions. Our lawyers write the book on vehicle repossessions. We train attorneys, law students and judges on the intricate rules of consumer finance and repossession law.

We are prepared to fight for your rights against the bank, credit union or finance company.

Lenders bring their A-team to court – so should you.

Did the Lender Violate my Rights?

State and Federal laws determine how lenders handle repossessions at the scene and after, the notices they must provide and the requirements to sell a seized vehicle. Borrowers have legal protections, whether payments were missed or not, without filing for bankruptcy.

CONSULT WITH FLITTER MILZ ABOUT YOUR VEHICLE REPOSSESSION

Lenders must follow the law when repossessing a vehicle whether or not the consumer fell behind on payments.

Did the Repo Agent Violate my Rights?

Repo agents do not have free rein when it comes to taking possession of your car, truck, motorcycle, boat or RV. They can’t threaten or use physical force to take your vehicle, or enter your fenced property without your permission. If you believe the repo agent violated your rights, document the event.

- Prepare a written statement explaining how the repossession unfolded: date, time, name of the repo company and agent, and description of events.

- Photograph the repo agent’s truck, including company name, contact information and license plate.

- Photograph any damage to your vehicle

- Photograph any property damage to lawns, gates, garage doors, or other vehicles.

- Call the police to the scene. File an incident report. Get names of the officers who responded to the scene.

- Gather witness statements with names and contact information.

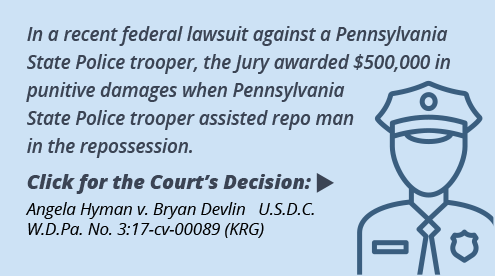

Police Involvement in Vehicle Repossessions

Keeping the Peace

The police may be contacted by the repo agent or the borrower during a vehicle repossession. Upon arrival at the scene, they are to keep the peace only, or to protect everyone from harm.

Breaching the Peace

The police are not to assist the repo agent in the repossession of your car. They are not to threaten arrest, or command that your vehicle, or the keys, be turned over to the repo agent. Once the police become involved in the repossession, they may have crossed the line from keeping the peace to breaching the peace. Police should not take sides in a civil dispute between private parties.

Flitter Milz Can Help.

Flitter Milz has helped people like you fight wrongful repossessions by problem lenders and repo agents. Contact us today, for a free legal review of your car, truck, motorcycle, boat or RV repossession, call 888-668-1225 or CHAT with us. If we accept your case, you will have no out of pocket expense.

No Charge Consultation. No Ongoing Fees.

Learn More About Car Repossession

- Borrowers have rights after vehicle repossession

- Repossession Class Action Lawsuit Designates Legal Services for cy pres

- What do I need to know about Auto Repossession?

- Cosigning a Loan = Risky Business

- Can I Keep my car if I file for Bankruptcy? 5 things to know.

- How to locate your car after repossession?

- Auto Repossession and the Pandemic

- Are there Advantages to a Voluntary Repossession?

- Understanding Vehicle Repossession and the Impact on Credit

- Dangers of Co-Signing an Auto Loan

- Resolution for the New Year: Create a Budget and Avoid Credit Problems

- My Car Was Repossessed. What do I need to know?

- Are You the Victim of a Wrongful Auto Repossession?

- Can I Be Sued for Not Paying My Car Loan?

- Understanding Auto Loan Financing

- What Can I do if my Car was Illegally Repossessed?

- Can the Police Help with My Car Repossession?

- How Long Does it take for a Repossession to come off your Credit Report?

- Will My Car Be Repossessed If I Miss One Payment?

- The Lender Sold My Repossessed Car. Why am I being sued?

- Car Repossessed? Now Getting Sued by My Auto Lender

- What Are the Laws Governing Motorcycle Repossession?

- What notices must my lender provide after repossession?

- 5 Things to Do After Your Car Has Been Repossessed

- My Car Was Repossessed. Can I Get It Back?