When banks record an increase in credit losses and delinquencies, often there is an uptick in repossessions. These indicators not only reflect repossessions of cars and trucks, but also pleasure vehicles, such as RVs, boats and motorcycles.

Fortunately for consumers, the laws that protect victims of car and truck repossessions, also apply to motorcycles, RVs and boats.

If you’ve fallen behind on your loan payments and are worried that your motorcycle, or other vehicle, is in danger of repossession, here’s what you need to know.

Motorcycle Repossession after Default

It’s understood that when you take out a loan to finance a motorcycle, you must abide by the terms of that contract. If a borrower defaults on those terms, the lender has the right to take back, or repossess, the bike. The finance contract will define what counts as a default. Typically, missed or incomplete payments, or a lack of insurance, constitute a default. Once the borrower defaults on the loan, the lender may come at any time to repossess it.

Having your motorcycle repossessed can feel like a major defeat, especially when you suspect your rights as a consumer have been violated in the process.

Consumer Protection after Default

Once a motorcycle has been repossessed there are laws that protect a borrower from a lender’s wrongful repossession tactics.

1. The Lender must provide Repossession Notices

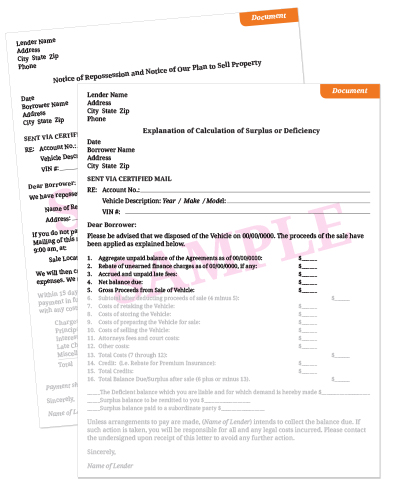

After a motorcycle repossession, the lender must provide specific written communications to the borrower. First, a letter that states terms to retrieve the bike, and second, if it is sold, a letter informing the borrower of the motorcycle’s selling price and any remaining balance owed on the loan. Whether the lender has repossessed a motorcycle or another vehicle, they must provide these letters to the borrower.

Notice of Intent to Sell Property.

Notice of Intent to Sell Property.

The repossession notice, or Notice of Intent to Sell Property, is sent to the borrower after the motorcycle has been repossessed. The letter will list terms that will allow the borrower to recover his or her motorcycle such as, the payments required, the time period to act, the location of the motorcycle and the date of the private sale or auction. Sometimes, the lender will allow the borrower to get their vehicle back by paying past-due payments to reinstate the loan. Other times, payment of the full loan may be required, plus the costs for repossession and storage fees.

If the borrower is not able to meet the terms stated in the repossession notice, the lender will arrange to sell the motorcycle at an auction or private sale. Once the bike has been sold, the lender must send a second notice to the borrower called a Notice of Deficiency. This letter will confirm the sale price, fees for storage and repossession and notify the borrower of any remaining balance owed on the loan. If you fail to pay back the Deficient Balance, the lender may assign the collection to a law firm or debt collection agency, which could subject you to a potential legal action by the lender and a black mark on your credit report.

2. Repo Agents can not threaten you

Motorcycle repossession are frequently volatile. However, the repo agent, who is a third-party hired by the lender to tow the bike, must follow the law too. They are not allowed to use physical force or threaten harm, and they are not permitted to enter someone’s property without permission. If the repo agent damages your property, or removes your motorcycle from a closed garage without your consent, your consumer rights may have been violated.

3. Police may not Breach the Peace

Many times the police are contacted by the repo agent or the borrower during a motorcycle repossession. The role of the police is to aid in keeping the peace, and make sure that no one is harmed or property damaged. They are not to assist with the repossession by threatening arrest or demanding the car or keys be released to the repo agent. Once the police become involved in aiding the repossession, they may have crossed the line from keeping the peace to breaching the peace. At this point the borrower’s constitutional rights may have been violated.

Many times the police are contacted by the repo agent or the borrower during a motorcycle repossession. The role of the police is to aid in keeping the peace, and make sure that no one is harmed or property damaged. They are not to assist with the repossession by threatening arrest or demanding the car or keys be released to the repo agent. Once the police become involved in aiding the repossession, they may have crossed the line from keeping the peace to breaching the peace. At this point the borrower’s constitutional rights may have been violated.

Victim of Motorcycle Repossession? Seek Legal Help from a Qualified Consumer Lawyer

The attorneys at Flitter Milz can help set things right. Our lawyers are experts in motorcycle repossession laws, with a proven record of taking action against banks, credit unions and other financial institutions for improper repossession tactics. Contact us today to find out how we can help you.