Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future.

Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future.

When an individual’s debt-to-income ratio rises, meaning that the person is taking on more debt than they are receiving in income, dire financial circumstances may occur for that person, and his or her family.

And if debt starts to get out of control and goes on unpaid for a period of time, debt collectors will no doubt start reaching out, your vehicle could get repossessed and credit scores could plummet.

It All Starts With Budgeting

The discipline of a budget helps keep a focus on income and payments towards all financial obligations. Develop a plan to meet your obligations and protect your credit rating.

1. Obtain Current Credit Reports

1. Obtain Current Credit Reports

One of the first steps toward keeping on top of your financial picture is to obtain current copies of your credit reports from the three main reporting agencies, Transunion, Experian and Equifax. You are entitled to one free credit report every 12 months from each credit bureau.

2. Evaluate Credit Reports for Accuracy

A review of your report will point out any negative entries and possibly errors, which could remain as black marks on your credit reports for up to seven-and-a-half years. These listings may affect terms on existing credit or your ability to obtain favorable terms on new lines of credit. If you discover errors on your reports, dispute the errors in writing directly with the credit bureau.

3. Where is your hard-earned money spent?

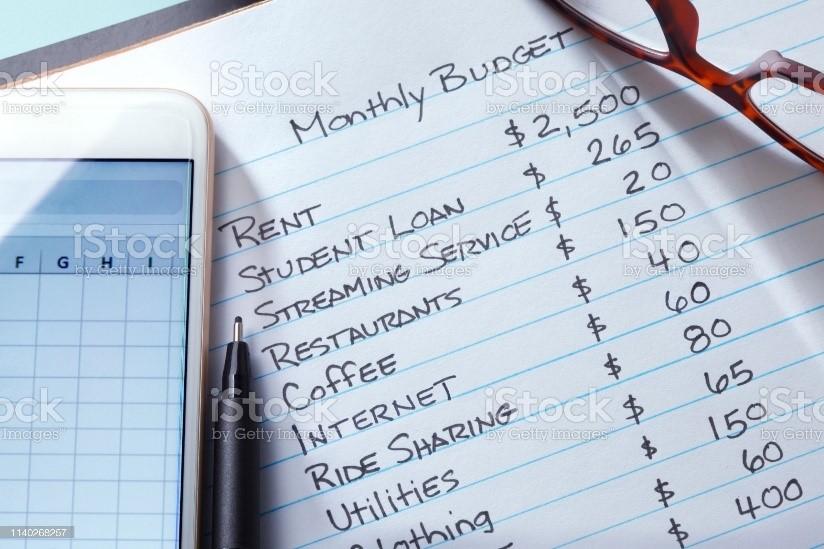

If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense.

If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense.

4. Develop a Budget that’s right for you.

It’s all about organization and discipline. Gather all of your paperwork, create files for each account, calendar your payments and focus on meeting your financial goals. These steps will help you meet your goals.

- Identify your income sources

- Compile a list of all expenditures: i.e. rent/mortgage, auto loan, insurance, food, credit cards, etc.

- Categorize expenses: i.e. essential/necessities versus extraneous/unnecessary

- Develop a plan to satisfy obligations within a specific time period

- Obtain current credit reports from Transunion, Experian and Equifax

- Establish both long and short-term financial goals.

- Develop a plan to meet your goals.

- Consider ways to earn or save more to help meet your goals

Seek Legal Help

Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle, Contact Us for a no-cost evaluation to determine whether your consumer rights may have been violated.

Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle, Contact Us for a no-cost evaluation to determine whether your consumer rights may have been violated.