As we’ve written before, consumers dealing with car repossession still have certain rights, regardless of how behind they might be on their payments.

For example, you have the right to be kept safe from an aggressive or abusive repo agent. They can’t break into your garage, damage your property or vehicle, or threaten you with physical harm.

Although the lender may be entitled to repossess a vehicle for the lack of payment or a lapse in auto insurance, AFTER a repossession the lender is required to provide the borrower with specific notices about the repossessed vehicle. Here’s what you should expect.

Notice of Intent to Sell Property

Notice of Intent to Sell Property

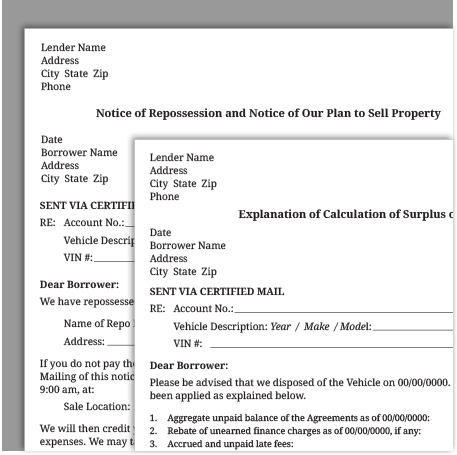

After a vehicle is repossessed, a letter, often called a Notice of Intent to Sell Property, is sent from the lender to the borrower with details of how to retrieve the vehicle. This letter will indicate any outstanding balance owed, the amount required to retrieve the vehicle, location of the vehicle for retrieval of personal property, and the time period to act before the vehicle would be sold at a private sale or auction. In addition, this letter may state fees for the cost of repossession and any storage charges by the repo agent.

Sometimes, the lender may permit the borrower to make past due payments allowing for reinstatement of the loan. But many times, the lender will require the borrower to pay off the full loan balance in order to get the vehicle back.

Deficiency Notice

Once the vehicle is sold, the lender will send a second letter to the borrower called a Deficiency Notice. This letter informs the borrower of the vehicle’s selling price at the auction or private sale. The lender deducts that amount, along with fees for towing and storage, and informs the borrower of the total remaining balance owed on the loan. As well, if the sale of the vehicle satisfied the balance owed, this letter will inform the borrower of the surplus.

Collection of Deficient Balances

Collection of Deficient Balances

When the deficient balance is not paid, often the lender will assign collection of this amount to a collection agency or law firm collector. The borrower will begin to receive collection phone calls and letters.

Sometimes, the lender may choose to take legal action against the borrower for collection of the deficient loan balance. If you are sued by the lender DO NOT ignore the lawsuit. A default judgment could be entered against you. Judgments are dangerous and could allow the lender to freeze bank accounts, place a lien on property, or possibly garnish wages – depending on the state where you live.

Get a Free Legal Evaluation

Are you the victim of a wrongful repossession? Have you received proper notices from the lender – a Notice of Intent to Sell Property? a Deficiency Notice? Or, have you been contacted by a debt collector or been sued over a deficient car loan balance? If so, the lender may have violated your consumer rights.

Are you the victim of a wrongful repossession? Have you received proper notices from the lender – a Notice of Intent to Sell Property? a Deficiency Notice? Or, have you been contacted by a debt collector or been sued over a deficient car loan balance? If so, the lender may have violated your consumer rights.

The consumer protection attorneys at Flitter Milz can help. We have a solid track record of protecting the borrower from improper car repossession practices. Contact us today for a free evaluation to determine whether your consumer rights were violated.