A high credit score makes many aspects of our lives more simple. It may be easier to purchase a home or car, secure a new line of credit, rent an apartment, or possibly be hired for a job or awarded a promotion.

What is a good credit score?

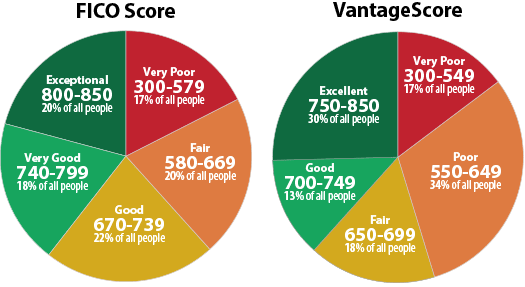

A credit score of 800 and above is considered excellent and indicates that the consumer not only uses credit, but pays bills in full and on time. A score in the 700s is considered good, however there may be some negative listing on the credit report such as late payments. Scores falling in the 600s are considered fair and may represent denial of a loan, or possibly approval but with lower credit limits or higher interest rates . Lower scores indicate to lenders that the consumer is a high credit risk and either, the consumer may be denied, or credit would be offered with unfavorable terms.

Image via Experian.com

Consumers with poor credit may seek ways to repair and improve their credit scores quickly. However, it’s a process that takes time and responsible financial management. Paying bills in full and on time, maintaining a low credit utilization, and paying off debt are critical steps. Also, a regular review of your credit report for accuracy is important. Every twelve months consumers are entitled to a free report from each, Transunion, Experian and Equifax. If there are errors listed on the credit report, the consumer should promptly dispute the errors.

Send a dispute letter to the bureau by US Mail with an explanation of the error and documents that support your claim. Be sure to keep a complete copy of your dispute. The credit bureaus have 30 days to respond to disputes. The bureau does not correct the error, you may need to re-dispute until your report has been corrected.

Seek Legal Help

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of credit reporting errors by credit data furnishers and the credit bureaus. Contact us for a free evaluation of your credit report errors for a potential violation of the Fair Credit Reporting Act.