A recent vehicle repossession class action lawsuit filed in the Lycoming County Court of Common Pleas on behalf of Pennsylvania consumers, asserted that repossession notices sent by a Buy-Here, Pay-Here car dealership and its finance company violated the borrower’s consumer rights. The class action provided for debt forgiveness, credit report correction, and a cash award to all class members.

Cy Pres Award to North Penn Legal Services

Residual funds, which result from uncashed or non-distributable funds to class members, were awarded to North Penn Legal Services (NPLS), a provider of free civil legal assistance to low-income residents of Northeastern Pennsylvania. These funds are designated as cy pres.

NPLS strives to solve civil legal problems and empower vulnerable populations through professional legal representation, advocacy, and education. NPLS will direct the cy pres funds to continue their work in assisting disadvantaged consumers in Northeastern Pennsylvania.

NPLS will direct the cy pres funds to continue their work in assisting disadvantaged consumers in Northeastern Pennsylvania.

Pictured (l-r): Edward G. Schirra, CFO, and Lori Molloy, Esq. of North Penn Legal Services, and Andy Milz, Esq. of Flitter Milz, P.C.

Experienced Class Action Counsel

Flitter Milz, P.C. is a leading consumer protection law firm that pursues class action lawsuits to help people who have been victim to wrongful repossessions, credit report errors, solar panel financing fraud, unfair collection practices, or other types of consumer fraud. Flitter Milz has been recognized for the pursuit of high-profile cases, often involving complex consumer law issues, that have made law and benefited consumers nationwide. Pictured above: Attorneys Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz, P.C. is a leading consumer protection law firm that pursues class action lawsuits to help people who have been victim to wrongful repossessions, credit report errors, solar panel financing fraud, unfair collection practices, or other types of consumer fraud. Flitter Milz has been recognized for the pursuit of high-profile cases, often involving complex consumer law issues, that have made law and benefited consumers nationwide. Pictured above: Attorneys Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

You might need to consider getting someone to cosign an auto loan if you are unable to qualify for the credit. Frequently, poor credit or lack of credit history, lack of income, or being able to make a down payment are reasons that a lender would require the borrower to get a cosigner. But co-signing holds a lot of responsibility…even if you’re doing it for a family member or close friend.

You might need to consider getting someone to cosign an auto loan if you are unable to qualify for the credit. Frequently, poor credit or lack of credit history, lack of income, or being able to make a down payment are reasons that a lender would require the borrower to get a cosigner. But co-signing holds a lot of responsibility…even if you’re doing it for a family member or close friend. The co-signer’s good name and credit history provide additional assurance to the lender that the terms of the loan agreement will be honored with payments being made in full and on time.

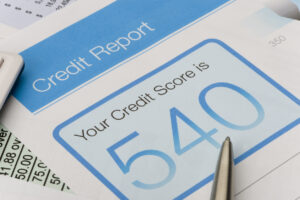

The co-signer’s good name and credit history provide additional assurance to the lender that the terms of the loan agreement will be honored with payments being made in full and on time. Both the co-signer and primary borrower hold equal responsibility for the signed auto loan. When payments are late or missed, the lender has the right to repossess the vehicle. Credit reports for both the borrower and co-signer will list a negative payment history and the repossession.

Both the co-signer and primary borrower hold equal responsibility for the signed auto loan. When payments are late or missed, the lender has the right to repossess the vehicle. Credit reports for both the borrower and co-signer will list a negative payment history and the repossession. The lender may contact the co-signer, and/or the primary borrower, after a vehicle has been repossessed. The bank, credit union or financial institution will look to the co-signer to bring the account current or satisfy the loan in full. Credit scores may drop as a result and impact existing credit, or make it difficult to obtain new credit for both the borrower and co-signer.

The lender may contact the co-signer, and/or the primary borrower, after a vehicle has been repossessed. The bank, credit union or financial institution will look to the co-signer to bring the account current or satisfy the loan in full. Credit scores may drop as a result and impact existing credit, or make it difficult to obtain new credit for both the borrower and co-signer. Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

However, there is a complicated intersection between auto finance law and bankruptcy. Before taking any action, borrowers must understand the implications of bankruptcy and be able to determine the most prudent steps to take before and after a vehicle has been repossessed. In general, merely having your car or truck repossessed is not enough to warrant filing for bankruptcy. Let’s try to simplify it.

However, there is a complicated intersection between auto finance law and bankruptcy. Before taking any action, borrowers must understand the implications of bankruptcy and be able to determine the most prudent steps to take before and after a vehicle has been repossessed. In general, merely having your car or truck repossessed is not enough to warrant filing for bankruptcy. Let’s try to simplify it. If your car was already repossessed, you have other rights as a consumer borrower, separate from any bankruptcy proceeding. Bankruptcy is only one tool or avenue if your car or truck has been repossessed – and it might, or might not, be right for your specific situation. Consult with an experienced consumer lawyer to understand your options outside of a bankruptcy.

If your car was already repossessed, you have other rights as a consumer borrower, separate from any bankruptcy proceeding. Bankruptcy is only one tool or avenue if your car or truck has been repossessed – and it might, or might not, be right for your specific situation. Consult with an experienced consumer lawyer to understand your options outside of a bankruptcy. If you’re concerned that the lender my repossess your vehicle, or perhaps thinking of filing bankruptcy to get your car back after repossession,

If you’re concerned that the lender my repossess your vehicle, or perhaps thinking of filing bankruptcy to get your car back after repossession,  Lenders are not required to notify the borrower in advance of an auto repossession. However, after a vehicle has been taken, the lender must send a letter to the borrower outlining terms to get the vehicle back — whether the lender is a bank, such as Well Fargo or Bank of America, a credit union, such as Pennsylvania State Employees Credit Union or Erie Federal Credit Union, or a financial institution such as Driveway Finance or PA Auto Credit. The repossession letter, often called a

Lenders are not required to notify the borrower in advance of an auto repossession. However, after a vehicle has been taken, the lender must send a letter to the borrower outlining terms to get the vehicle back — whether the lender is a bank, such as Well Fargo or Bank of America, a credit union, such as Pennsylvania State Employees Credit Union or Erie Federal Credit Union, or a financial institution such as Driveway Finance or PA Auto Credit. The repossession letter, often called a  After the lender has made the decision to repossess a vehicle, arrangements are made with a repo agent who will locate the vehicle and take it, often without warning. In advance of the repossession, the repo agent must inform the local police department of their intent to seize the vehicle. The repo agent may come with a tow truck to the borrower’s home or place of employment. Or, they may track the vehicle

After the lender has made the decision to repossess a vehicle, arrangements are made with a repo agent who will locate the vehicle and take it, often without warning. In advance of the repossession, the repo agent must inform the local police department of their intent to seize the vehicle. The repo agent may come with a tow truck to the borrower’s home or place of employment. Or, they may track the vehicle  finding it at another location, such as at a shopping mall, doctor’s office, or the address of a family member or friend. Sometimes at the time of purchase, the dealership may have installed a GPS tracking device or a remote control car disabler. The repo agent may use these devices to track vehicles that have been assigned for repossession.

finding it at another location, such as at a shopping mall, doctor’s office, or the address of a family member or friend. Sometimes at the time of purchase, the dealership may have installed a GPS tracking device or a remote control car disabler. The repo agent may use these devices to track vehicles that have been assigned for repossession. In Pennsylvania, a repossession agent has to be licensed with the Department of Banking and Securities of the Commonwealth and may be hired by a bank, credit union or finance company to repossess cars, trucks motorcycles, RVs, powersport vehicles, boats or airplanes. If a vehicle is missing, the borrower should make calls to the local police and the lender to confirm it was not stolen.

In Pennsylvania, a repossession agent has to be licensed with the Department of Banking and Securities of the Commonwealth and may be hired by a bank, credit union or finance company to repossess cars, trucks motorcycles, RVs, powersport vehicles, boats or airplanes. If a vehicle is missing, the borrower should make calls to the local police and the lender to confirm it was not stolen. Flitter Milz has the expertise in representing borrowers whose vehicles have been wrongfully repossessed by banks, credit unions and financial companies.

Flitter Milz has the expertise in representing borrowers whose vehicles have been wrongfully repossessed by banks, credit unions and financial companies.

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle.

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle. can’t meet the terms agreed upon in their auto loan agreement.

can’t meet the terms agreed upon in their auto loan agreement. First, after taking back the vehicle, the lender will send a repossession notice, or

First, after taking back the vehicle, the lender will send a repossession notice, or

The hard facts about Repossession.

The hard facts about Repossession. When the borrower

When the borrower  Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to

Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to  Send Effective Disputes

Send Effective Disputes Being asked to co-sign a loan for a family member or close friend is a larger responsibility than most people realize. When you co-sign a loan, such as an auto loan, you and your credit are on the hook if that relative or friend decides to stop making payments on the loan. In other words, by co-signing, you are a co-borrower and must accept responsibility of terms stated in the loan agreement.

Being asked to co-sign a loan for a family member or close friend is a larger responsibility than most people realize. When you co-sign a loan, such as an auto loan, you and your credit are on the hook if that relative or friend decides to stop making payments on the loan. In other words, by co-signing, you are a co-borrower and must accept responsibility of terms stated in the loan agreement. Once the vehicle is sold, the lender may assign collection of the deficient balance to a debt collector or law firm collector. If the loan balance is not paid, the lender could choose to

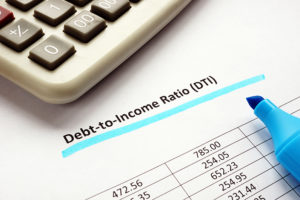

Once the vehicle is sold, the lender may assign collection of the deficient balance to a debt collector or law firm collector. If the loan balance is not paid, the lender could choose to  Co-signing a loan should not be taken casually. The co-signer must consider whether or not credit may be needed for him or herself. If a co-signer has too much

Co-signing a loan should not be taken casually. The co-signer must consider whether or not credit may be needed for him or herself. If a co-signer has too much  individual the money for the purchase. In other words, you lend the individual the money and they pay you back in installments over time, or whatever agreement the two of you come up with.

individual the money for the purchase. In other words, you lend the individual the money and they pay you back in installments over time, or whatever agreement the two of you come up with.