The three main national credit bureaus — Trans Union, Equifax, and Experian — have agreed to make changes in the reporting of medical debt. As of July 1, 2022, settled medical debt that would normally remain on credit reports for up to 7 1/2 years should come off the report. As a result, consumers may see an increase in their credit score, a benefit which can open doors to borrowing at more favorable rates for housing, loans and credit cards.

The three main national credit bureaus — Trans Union, Equifax, and Experian — have agreed to make changes in the reporting of medical debt. As of July 1, 2022, settled medical debt that would normally remain on credit reports for up to 7 1/2 years should come off the report. As a result, consumers may see an increase in their credit score, a benefit which can open doors to borrowing at more favorable rates for housing, loans and credit cards.

Three Important Changes to Credit Reporting

Change #1: As soon as a medical debt is paid, it will be removed from the consumer’s credit reports. This means if you’ve paid your medical bill in full and the debt still appears on your credit report as a negative mark, the tradeline and any late pay history on the credit report, will be removed.

Change #2: The period to report unpaid medical debt will increase from six months to one year. This will give people a chance to pay the medical debt off, work with a health insurance carrier, or dispute it before credit problems arise.

Change #3: In the first half of 2023, all medical collection debt with an initial reported balance of less than $500 will be removed from credit reports. This will result in nearly 75% of medical debt to disappear from consumer credit reports.

Medical Debt is usually unforeseen

Let’s face it. Most medical debt is incurred unexpectedly. Patients visit doctors or seek medical treatment because they are sick or have had an injury. Due to the high cost of healthcare, many Americans have difficulty paying expensive medical bills to hospitals, physicians, labs and other medical providers.

Let’s face it. Most medical debt is incurred unexpectedly. Patients visit doctors or seek medical treatment because they are sick or have had an injury. Due to the high cost of healthcare, many Americans have difficulty paying expensive medical bills to hospitals, physicians, labs and other medical providers.

Collectors must follow the law

Unfortunately, unpaid medical debt may be forwarded to a collection agency or law firm collector. Once in collection, negative tradelines appear on credit reports and credit scores may drop. Consumers then begin to feel the effects of a negative credit rating.

Unfortunately, unpaid medical debt may be forwarded to a collection agency or law firm collector. Once in collection, negative tradelines appear on credit reports and credit scores may drop. Consumers then begin to feel the effects of a negative credit rating.

Common impact of a negative credit rating

-Credit term changes, i.e. credit limits lowered, or interest rates increased

-Loan applications denials

-Landlords application denials

-Job offers or promotions retracted

Federal Laws Protecting Consumer’s Rights

The following consumer protection laws provide protections for consumers from inaccurate information appearing on credit reports and abusive collection practices by debt collectors.

Fair Credit Reporting Act

The Fair Credit Reporting Act governs how consumer credit information can be used and distributed. It gives the consumer rights to view credit reports and dispute inaccurate information. Consumers should obtain current copies of their credit reports from Transunion, Experian and Equifax at least every year. When information is listed incorrectly, the consumer must take steps to dispute the errors. The credit bureaus are required to investigate disputes and fix or delete inaccurate information within 30 days of a consumer dispute. If they don’t, they may have broken the law.

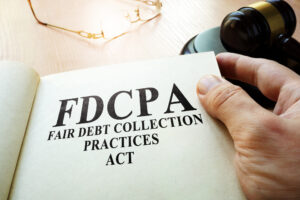

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act is a federal law that provides legal protections for consumers from a collector’s abusive collection tactics. Common violations to this law include:

- Harassment or abusive contact

- Threaten a lawsuit when none is intended

- Misrepresentation, miscalculation, or inflation of the debt

- Provide false or misleading information to the credit bureau

- Continue to collect after filing for bankruptcy

When collecting medical debt from consumers, or other personal and household obligations, debt collectors must follow the law. Violations to the FDCPA allow the consumer to pursue legal action against the collector, and the collector will be responsible for legal fees.

Get Qualified Legal Help from Experienced

Consumer Protection Lawyers

Attorney Andy Milz states, “Here at Flitter Milz, PC, we strongly believe medical debt should not be reported at all. Unlike a mortgage, credit card, or car loan, medical debt does not represent a financial choice, but is often a result of an emergency or hardship. And, even for the majority of consumers with some form of health insurance, getting the insurance company to pay the bill in its entirety is always a challenge. Inability to pay medical debts should not weigh down a person’s creditworthiness. Unfortunately, until now, health care providers, medical debt collectors, and the credit bureaus have been allowed to report this negative information.”

Attorney Andy Milz states, “Here at Flitter Milz, PC, we strongly believe medical debt should not be reported at all. Unlike a mortgage, credit card, or car loan, medical debt does not represent a financial choice, but is often a result of an emergency or hardship. And, even for the majority of consumers with some form of health insurance, getting the insurance company to pay the bill in its entirety is always a challenge. Inability to pay medical debts should not weigh down a person’s creditworthiness. Unfortunately, until now, health care providers, medical debt collectors, and the credit bureaus have been allowed to report this negative information.”

Flitter Milz is a consumer protection law firm that concentrates in the specialized area of credit reporting and addresses accuracy and privacy and violations of the FCRA, and abusive contact by debt collectors that violate the FDCPA. Our firm has obtained millions of dollars in relief for consumers whose credit reputations have been damaged. If inaccurate credit information is affecting your life, or you have been contacted by an abusive debt collector, contact us, for a no cost consultation.

Flitter Milz is a consumer protection law firm that concentrates in the specialized area of credit reporting and addresses accuracy and privacy and violations of the FCRA, and abusive contact by debt collectors that violate the FDCPA. Our firm has obtained millions of dollars in relief for consumers whose credit reputations have been damaged. If inaccurate credit information is affecting your life, or you have been contacted by an abusive debt collector, contact us, for a no cost consultation.

Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz is a nationally recognized consumer protection law firm experienced in representing consumers who have suffered from abusive debt collection practices and credit reporting errors.

Flitter Milz is a nationally recognized consumer protection law firm experienced in representing consumers who have suffered from abusive debt collection practices and credit reporting errors.