Errors on your credit reports can derail your finances, and sometimes prevent you from obtaining the credit you may need. By checking your credit reports regularly with the three main bureaus — Transunion, Experian and Equifax — you can make sure negative entries and inaccurate listings don’t stand in your way of getting the car loan, mortgage, job or apartment you deserve. Take these steps to work towards your financial freedom.

Errors on your credit reports can derail your finances, and sometimes prevent you from obtaining the credit you may need. By checking your credit reports regularly with the three main bureaus — Transunion, Experian and Equifax — you can make sure negative entries and inaccurate listings don’t stand in your way of getting the car loan, mortgage, job or apartment you deserve. Take these steps to work towards your financial freedom.

TRUE STORY from Flitter Milz

Our client purchased a new car after trading in his old car. The finance company failed to report to the credit bureaus that his old car loan was paid in full, and reported him late for several months. The credit bureaus refused to correct their reporting, despite the client’s dispute letters. After hiring Flitter Milz to help sue the credit bureaus. The credit bureaus paid a confidential settlement for slandering his credit.

Step 1: Write for your credit reports

Request a current report from each of the three main credit bureaus –Transunion, Experian, and Equifax. You will need to enclose two forms of identification, such as a current driver’s license and utility bill, with your letter. CLICK HERE: Obtain credit reports from Transunion, Experian and Equifax.

Step 2: Identify problems on your report

Credit reports show the history of credit accounts and illustrate whether a consumer is a good credit risk. Consumers must review their reports for accuracy and take steps to correct inaccurate information. Common credit reporting problems are:

Credit reports show the history of credit accounts and illustrate whether a consumer is a good credit risk. Consumers must review their reports for accuracy and take steps to correct inaccurate information. Common credit reporting problems are:

- Mixed Files

Someone else’s information on your report. For example, family members or people with similar names could be mixed with your file. CLICK HERE: Is your Credit Report mixed with someone else’s information?

- Ex-spouse’s information

It’s a common misperception that a divorce decree changes contracts with lenders. Actually, the divorce decree is only an agreement between you and the court. After divorce if an ex-spouse’s information is listed on your credit accounts, you must write the creditor to have his or her name removed.

CLICK HERE: How to maintain good credit during divorce.

- Incorrect notations for Closed Accounts

A closed account on your credit report is an account that is no longer active, meaning it was either closed upon your request or automatically closed by the creditor. The effect of a closed account on your credit report may differ depending on the account standing. An account in positive standing won’t have any negative payment history. Should an account appear to be closed by the creditor when you closed it, this notation could carry negative weight on your credit report and the notation must be corrected.

- Public Record Errors

Judgments, tax liens, bankruptcies, and lawsuits must be listed accurately on credit reports. If a public record is listed incorrectly, or does not belong to you, a dispute letter must be sent to the credit bureau with documents that explain the error.

- Bankruptcy listings

Accounts discharged in bankruptcy need to be identified correctly on your credit report as “discharged in bankruptcy”. In some cases, a bankruptcy can appear on your report because of mistaken identity, identity theft, administrative mistakes, or a completely random error.

- Identity Theft

Accounts opened fraudulently in your name or used without your authorization could appear on your credit reports. Specific steps to stop the theft need to be taken. CLICK HERE: What to do if your Identity is Stolen

- Strange Inquiries

You must provide permission for someone to access your credit report. If there are entries you do not recognize, letters must be sent to the credit bureau to request who obtained your report and for what reason.

- Obsolete Information

In most cases, a credit reporting agency may not report negative information that is more than 7 years old, or bankruptcies that are more than 10 years old. When outdated information is listed on credit reports, a dispute letter must be sent to the credit bureau with documents that support your request for the information to be corrected.

- Errors

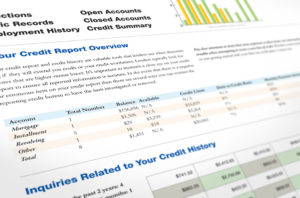

Incorrect payment histories, payment status, closed accounts, etc. must be listed accurately. When credit reports list incorrect information, written disputes must be submitted to the bureaus with documents that support your dispute and illustrate why the error is to be corrected. CLICK HERE: Learn how to read a credit report

Step 3: Have a No Cost Legal Review

Flitter Milz attorneys are nationally recognized consumer protection lawyers with the experience to evaluate your credit reporting problems.

Flitter Milz attorneys are nationally recognized consumer protection lawyers with the experience to evaluate your credit reporting problems.

To provide a no cost legal evaluation, we will request that you provide a current copy of your report from each of the three main bureaus — Transunion, Experian, and Equifax, plus documents that illustrate why the information must be corrected. If it appears that you have a valid problem, we may request that you send disputes to the credit bureaus and/or credit furnishers in an attempt to get the problem corrected. Should the error remain, there may be a violation to your consumer rights.

CLICK HERE: Learn to Dispute Credit Report Errors Effectively

Flitter Milz Attorneys (pictured above):

Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Consumer credit is when credit is advanced to a consumer for the purchase of personal or household goods or services. The system for extension of credit allows consumers to borrow money, or incur debt, and to defer repayment of that money over time.

Consumer credit is when credit is advanced to a consumer for the purchase of personal or household goods or services. The system for extension of credit allows consumers to borrow money, or incur debt, and to defer repayment of that money over time. Having

Having  Consumers may explore options to finance the purchase by contacting banks, credit unions and financial institutions. The terms for borrowing money may vary from one lender to another. After submission of a credit application, lenders take steps to evaluate the borrower’s creditworthiness. Typically, a credit application triggers a

Consumers may explore options to finance the purchase by contacting banks, credit unions and financial institutions. The terms for borrowing money may vary from one lender to another. After submission of a credit application, lenders take steps to evaluate the borrower’s creditworthiness. Typically, a credit application triggers a  Borrowers must be prepared for the lender to approve or

Borrowers must be prepared for the lender to approve or  A credit reference is one of the methods lenders and service providers use to determine a borrower’s creditworthiness. Credit references can include your bank, previous landlords, employers, or companies whose bills you’ve paid regularly. Depending on the type of application, it is best to submit the best reference for the situation. Typically, this person or company would improve the borrower’s chances for approval for the type of loan that is sought.

A credit reference is one of the methods lenders and service providers use to determine a borrower’s creditworthiness. Credit references can include your bank, previous landlords, employers, or companies whose bills you’ve paid regularly. Depending on the type of application, it is best to submit the best reference for the situation. Typically, this person or company would improve the borrower’s chances for approval for the type of loan that is sought.  If you’ve been denied credit due to errors on your credit report, contact Flitter Milz for a no cost case evaluation. Errors on credit reports can lower your credit score, which can hurt your ability to get new lines of credit or receive favorable terms on a new loan.

If you’ve been denied credit due to errors on your credit report, contact Flitter Milz for a no cost case evaluation. Errors on credit reports can lower your credit score, which can hurt your ability to get new lines of credit or receive favorable terms on a new loan.  A car purchase is one of the most exciting purchases a consumer makes. But let’s face it, cars are expensive and you have to figure out how to pay for them.

A car purchase is one of the most exciting purchases a consumer makes. But let’s face it, cars are expensive and you have to figure out how to pay for them. Before visiting the dealership, consumers must review their finances and evaluate payment options. Informed buyers allow for making the best car buying decisions. Car salespeople are known to pressure potential buyers in to selecting vehicles from their lot — often ones the consumer may not want or be able to afford.

Before visiting the dealership, consumers must review their finances and evaluate payment options. Informed buyers allow for making the best car buying decisions. Car salespeople are known to pressure potential buyers in to selecting vehicles from their lot — often ones the consumer may not want or be able to afford. the consumer’s credit accounts, including balances and payment history. When reports reflect incorrect information, lenders may deny applications for credit.

the consumer’s credit accounts, including balances and payment history. When reports reflect incorrect information, lenders may deny applications for credit. institutions review the consumer’s credit reports and scores in the process of determining whether to extend credit or not. Various factors are considered in the evaluation process:

institutions review the consumer’s credit reports and scores in the process of determining whether to extend credit or not. Various factors are considered in the evaluation process: Shop for the Financing

Shop for the Financing Understand credit scores and credit reports

Understand credit scores and credit reports credit and obtain copies of his or her credit reports and credit scores.

credit and obtain copies of his or her credit reports and credit scores. Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.  Do you have errors on your credit reports? Problems getting credit?

Do you have errors on your credit reports? Problems getting credit?