Titan Solar is a door-to-door sale company that sells and installs solar products like rooftop solar panel systems. Titan Solar teams up with finance companies like Goodleap to finance the installation through loans and power purchase agreements.

Common Complaints about Titan Solar

In online complaints, Titan Solar has been accused of engaging in predatory marketing and of misrepresenting facts. Sometimes, Titan Solar is accused of not informing the customer that installation is conditioned upon agreeing to a decades-long loan or power purchase agreement, and the contract might be hidden from the consumer. Titan Solar’s finance company partner may also pull your credit report without your permission.

In online complaints, Titan Solar has been accused of engaging in predatory marketing and of misrepresenting facts. Sometimes, Titan Solar is accused of not informing the customer that installation is conditioned upon agreeing to a decades-long loan or power purchase agreement, and the contract might be hidden from the consumer. Titan Solar’s finance company partner may also pull your credit report without your permission.

Impermissible Credit Pull

Doesn’t a company need your consent to pull your credit report?

Generally, yes. If you did not consent to your credit being pulled, the company that did so must have  some other legitimate business purpose for pulling your credit. Often, during the process of applying for new credit or utilities, or interviewing with a prospective employer or landlord, there may be a request to access the consumer’s credit file. The consumer must provide written permission for his or her credit file to be accessed.

some other legitimate business purpose for pulling your credit. Often, during the process of applying for new credit or utilities, or interviewing with a prospective employer or landlord, there may be a request to access the consumer’s credit file. The consumer must provide written permission for his or her credit file to be accessed.

Consumer Rights for Impermissible Credit Pull

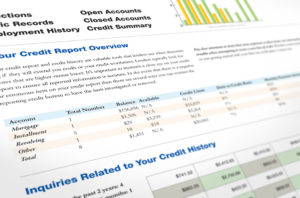

When a credit report has been accessed without the consumer’s permission, there may have been a violation to the Fair Credit Reporting Act. The FCRA is a federal law governing how consumer credit information can be used and distributed. Consumers may dispute inaccurate information and inquire about companies who accessed their credit file that they do not recognize.

Check your Credit and Dispute Errors

Before applying for new credit, consumers should obtain current copies of their reports from the three main bureaus – Transunion, Experian and Equifax. The reports should be viewed for accuracy and privacy. If errors or unfamiliar information is listed, written disputes should be sent to the credit bureau through the US Mail. The bureaus have 30 days to respond.

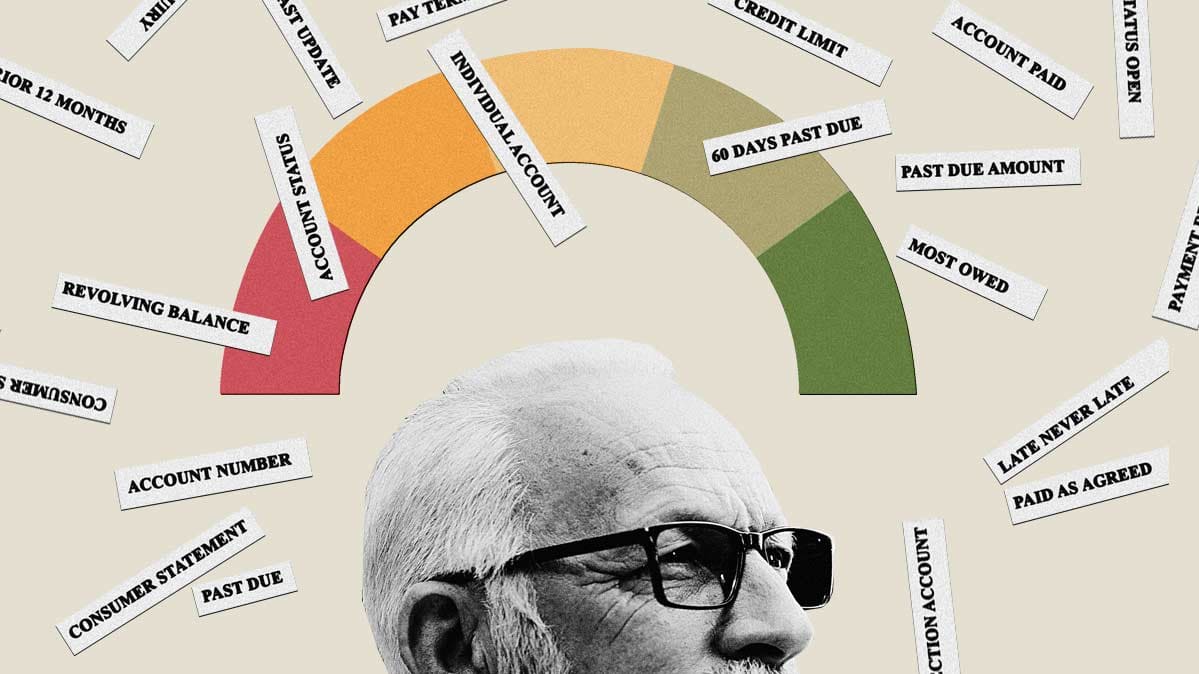

Disadvantage of Hard Pulls on Credit Report

If there was a “hard pull” of your credit report, it could harm your credit standing going forward. Hard pulls will stay on your credit file for two years, and as a result over that time period, you might lose out on other job, housing, or credit opportunities.

Lenders evaluate the number of hard inquiries that appear on a consumer’s credit reports during the credit application review process. Although hard inquiries represent one factor in the calculation of credit scores, too many hard inquiries in a short time could impact scores negatively and jeopardize the approval of a new credit application.

Lenders evaluate the number of hard inquiries that appear on a consumer’s credit reports during the credit application review process. Although hard inquiries represent one factor in the calculation of credit scores, too many hard inquiries in a short time could impact scores negatively and jeopardize the approval of a new credit application.

Better Business Bureau Complaints about Titan Solar

Hundreds of consumers have complained about Titan Solar’s business practices to the Better Business Bureau. As of the date of this writing, customers on the Better Business Bureau site have rated Titan Solar 1.87 stars out of five. Some consumers have made the following types of complaints:

- Never saw, signed for, or received a contract or loan agreement.

- Were signed up for a loan without giving permission.

- Were sold more panels that needed for the home

- Poor performance resulting in higher energy costs.

Protect Yourself from Solar Panel Sales Scams

Consumers must use caution while considering a solar power contract. If there are problems, address them quickly whether they’re with the solar sales company, the panel installer, or the finance company. Otherwise the results can be devastating and put you in thousands of dollars in debt. Solar panel loans or power purchase agreements can last for 20 or 25 years, resulting in burdensome monthly payments on top of an expensive electricity bill.

Contact an Experienced Consumer Protection Law Firm

Did Titan Solar reach out to you to have solar panels installed without disclosing the existence of a loan or power purchase agreement? Has a Titan Solar salesperson offered you “free” solar panels without mentioning a loan? Have you received an alert that your credit has been pulled, and you never gave permission to the salesperson to do so? If the answer to any of these questions is yes, contact Flitter Milz for a no cost legal evaluation. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Did Titan Solar reach out to you to have solar panels installed without disclosing the existence of a loan or power purchase agreement? Has a Titan Solar salesperson offered you “free” solar panels without mentioning a loan? Have you received an alert that your credit has been pulled, and you never gave permission to the salesperson to do so? If the answer to any of these questions is yes, contact Flitter Milz for a no cost legal evaluation. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Understand credit scores and credit reports

Understand credit scores and credit reports What is a credit score?

What is a credit score? credit and obtain copies of his or her credit reports and credit scores.

credit and obtain copies of his or her credit reports and credit scores. Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.  Do you have errors on your credit reports? Problems getting credit?

Do you have errors on your credit reports? Problems getting credit?

The hard facts about Repossession.

The hard facts about Repossession. When the borrower

When the borrower  Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to

Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to  Send Effective Disputes

Send Effective Disputes

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit. Consumers are entitled to

Consumers are entitled to  If you notice errors on your credit reports, you must

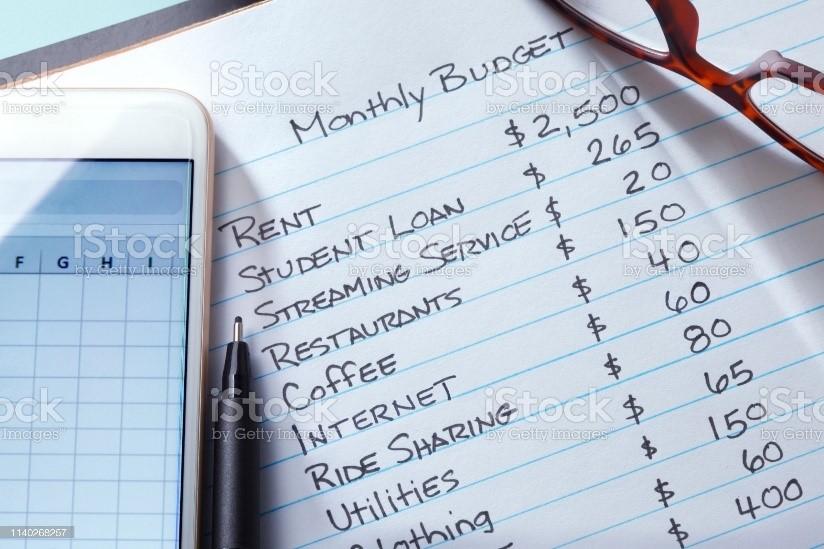

If you notice errors on your credit reports, you must  Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future.

Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future. 1. Obtain Current Credit Reports

1. Obtain Current Credit Reports If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense.

If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense. Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,

Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,