Electronic payments are part of everyday life. Using a debit card, withdrawing cash from an ATM, paying bills automatically, sending money through a payment app, or receiving your direct deposit all involve moving money electronically into or out your bank account. These payments transact very quickly and often without a paper record. Correcting the errors can be very challenging and time consuming.

Electronic payments are part of everyday life. Using a debit card, withdrawing cash from an ATM, paying bills automatically, sending money through a payment app, or receiving your direct deposit all involve moving money electronically into or out your bank account. These payments transact very quickly and often without a paper record. Correcting the errors can be very challenging and time consuming.

When banks fail to properly handle disputed transactions, or withhold funds in bad faith, consumers may be able to pursue a lawsuit against the bank. Do not assume the bank’s denial of your request for refund or refusal to correct an error is final. You have rights.

What is an Electronic Transfer?

Legally, an “electronic transfer” is considered one where money is moved between accounts using computer-based systems that rely on secure networks to send electronic instructions between financial institutions. Transactions initiated by check or telephone are not considered electronic transfers.

Legally, an “electronic transfer” is considered one where money is moved between accounts using computer-based systems that rely on secure networks to send electronic instructions between financial institutions. Transactions initiated by check or telephone are not considered electronic transfers.

What is an Authorized Transaction?

Authorized transactions are ones that have been initiated or approved by the consumer, even if the purchase is regretted later or the consumer believes he or she was misled. Frequently, banks deny reimbursement and claim the payment was authorized. For example, when a consumer provides a debit card number and account security codes to a merchant for a subscription or product, and funds are transferred through a payment app, banks often regard those payments as authorized.

What is an Unauthorized Electronic Payment?

An “unauthorized” electronic payment is one that was not approved, not expected, and where no benefit was received by the consumer. Often this occurs when a debit card is stolen, account information is compromised, or someone gains access to online banking accounts without the consumer’s knowledge.

An “unauthorized” electronic payment is one that was not approved, not expected, and where no benefit was received by the consumer. Often this occurs when a debit card is stolen, account information is compromised, or someone gains access to online banking accounts without the consumer’s knowledge.

The difference between authorized and unauthorized fund transfers is not always clear. Sometimes the consumer may be a victim of identity theft. Unauthorized transactions may occur once account credentials are stolen. As well, access to accounts for withdrawal or transfer may become limited. Consumers have legal recourse when banks limit or freeze access to accounts in error.

Review Account Statements for Accuracy

Consumers must review bank statements regularly for accuracy and evaluate whether any listed transactions are erroneous. If a transaction was made without permission, there are two questions: Who is responsible for the error? Should the bank return the funds, or is the consumer left responsible for the loss?

Consumers must review bank statements regularly for accuracy and evaluate whether any listed transactions are erroneous. If a transaction was made without permission, there are two questions: Who is responsible for the error? Should the bank return the funds, or is the consumer left responsible for the loss?

5 Steps to Correct Unauthorized Transactions

Speed matters. Consumers may have strong protections to unauthorized transactions, however, it is mandatory that consumers review bank statements for accuracy. If a merchant or transaction amount is unfamiliar or incorrect, promptly take these steps.

1) Send a WRITTEN dispute within 60 days via Certified Mail of a transaction appearing on the billing statement.

2) Clearly state the issue and provide details related to date, errors, and steps

you would like the bank to take.

3) Enclose a copy of the billing statement with the disputed item highlighted.

4) Attach supporting documents which illustrate the error, such as:

-Records showing your location elsewhere (i.e. parking receipts, flight tickets,

geolocated photos, etc.);

-Proof that your card was in your possession; or

-Written or dated communication with the merchant showing you did not

authorize the purchase.

5) Request a written reply with confirmation that the dispute was addressed.

Once the bank receives the written dispute, they may provisionally credit your account for the amount of the erroneous transfer. However, they will follow procedures for investigation of the issue. A determination will be made of whether the transaction was actually approved by you. A written reply will be sent identifying the next actions.

Once the bank receives the written dispute, they may provisionally credit your account for the amount of the erroneous transfer. However, they will follow procedures for investigation of the issue. A determination will be made of whether the transaction was actually approved by you. A written reply will be sent identifying the next actions.

Seek Qualified Legal Help

Flitter Milz attorneys evaluate matters where consumers identify suspicious electronic funds transferred from bank accounts. Contact us for a no cost consultation to determine whether the consumer protection laws have been violated. Toll Free: 888-668-1225

Flitter Milz attorneys evaluate matters where consumers identify suspicious electronic funds transferred from bank accounts. Contact us for a no cost consultation to determine whether the consumer protection laws have been violated. Toll Free: 888-668-1225

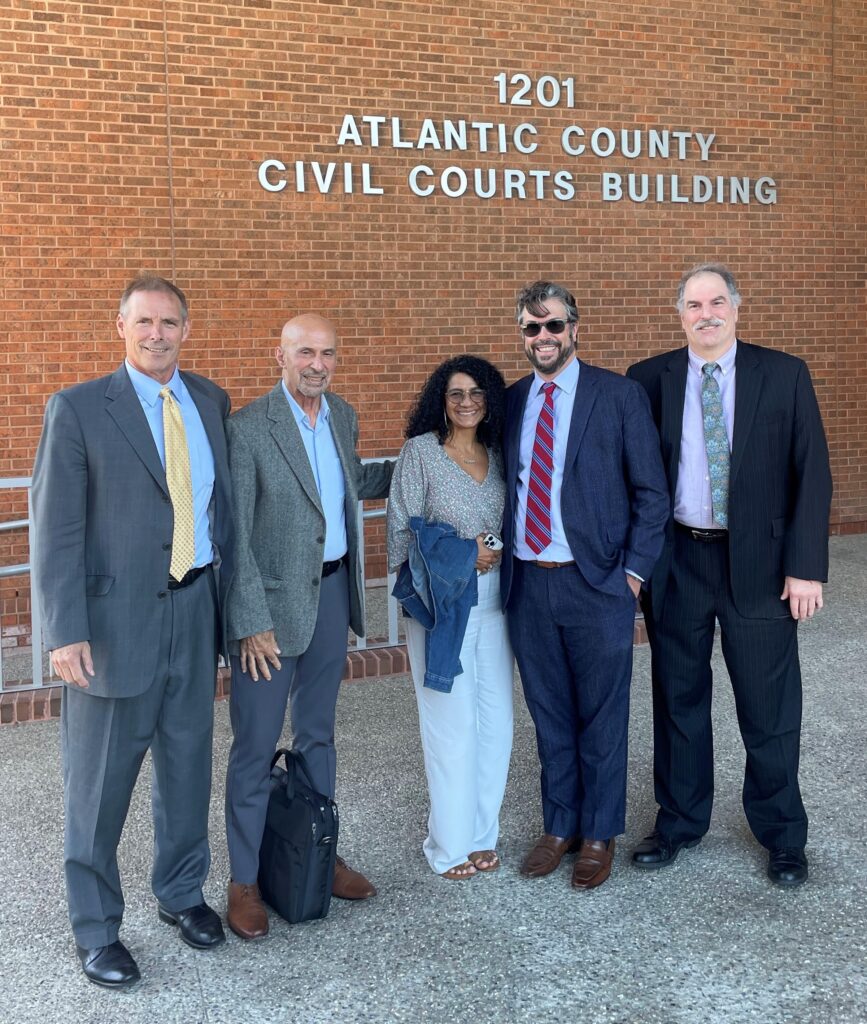

Attorneys (l-r): Andy Milz, Ed Flitter, Cary Flitter, Jody López-Jacobs

Electronic signatures—or e-signatures—are everywhere. We click “Agree” or type our name on a device to open bank accounts, purchase vehicles, rent apartments, or accept online terms. Before you sign electronically, here’s what to know.

Electronic signatures—or e-signatures—are everywhere. We click “Agree” or type our name on a device to open bank accounts, purchase vehicles, rent apartments, or accept online terms. Before you sign electronically, here’s what to know. 1. The option to receive paper copies

1. The option to receive paper copies The key is intent—you must intend to sign the electronic contract that your signature is applied to. But some companies may forge or copy and paste e-signatures to contracts that were never approved by the consumer. Forging an e-signature is illegal, just like forging a signature in ink on paper.

The key is intent—you must intend to sign the electronic contract that your signature is applied to. But some companies may forge or copy and paste e-signatures to contracts that were never approved by the consumer. Forging an e-signature is illegal, just like forging a signature in ink on paper.

While e-signatures are legal on many documents, some notices, such as those listed below, are required to be delivered in paper form and signed in ink. This is to insure that the person is fully informed and in agreement with the document.

While e-signatures are legal on many documents, some notices, such as those listed below, are required to be delivered in paper form and signed in ink. This is to insure that the person is fully informed and in agreement with the document.

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape.

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape. In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than  Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).