Because your credit affects so many aspects of your life, it’s important to check your credit report regularly to make sure all information is correct and up to date. Correcting negative listings on your reports can seem like a long and complicated process. But you have the right to dispute credit report errors if any of the listings are inaccurate.

The Dispute Process

- Request current credit reports from Transunion, Experian, and Equifax

You can request a free copy of your credit report from Transunion, Experian, and Equifax once every twelve months. You can get a free report more often if certain events occur, such as denial of a credit application or identity theft.

You should request a copy of your credit report from each bureau to make sure that your information is accurate with all three. The bureaus report similar information, but listings can still differ from one report to another. Review all of your reports for accuracy.

WRITE to Transunion, Experian, and Equifax for a copy of your report.

Although you may be able to obtain your report online annualcreditreport.com, we recommend that you request them through the US Mail. Online, you must accept the terms of a “click” agreement which has language that could affect your ability to bring a lawsuit if the credit bureaus violate your consumer rights.

- Identify credit report errors

Review each credit report for errors. You many need to locate documents such as account statements, invoices, cancelled checks, court dockets or correspondence from a creditor or collector that proves why the listing is incorrect. Gather your documents and attach them to your dispute letter.

Five Common Credit Reporting Errors

- Inaccurate payment history

- Incorrect information, such as your name, address, birth date, SSN

- Someone else’s information on your report.

- Duplicate information: two listings for the same account.

- Unauthorized accounts: accounts opened without your knowledge

- File a credit report dispute

Send your disputes to the credit bureau through the US Mail, and preferably by a traceable means, such as Certified Mail, Return Receipt. You need to have proof that your dispute letter was received.

Tips for an effective credit report dispute

- Keep your letter concise and to the point. State why the information is incorrect.

- Dispute only one item per letter. If there are two errors, send two separate letters.

- Include the credit report date, report number, and page listing of the disputed item on your letter.

- Enclose supporting documentation.

- Clearly state the action you would like the credit bureau to take.

- Keep a copy of your complete dispute letter with supporting documents and mailing receipts.

- What to do if the inaccurate information remains

Under the Fair Credit Reporting Act, the bureaus are responsible for correcting inaccurate information. If the credit bureau has not corrected the information detailed in your dispute letter, you may need to:

- Re-dispute with the bureau

- Send a dispute letter to the creditor

- Contact a qualified credit report lawyer to evaluate your credit reports, disputes, and responses from the bureaus.

Seek Legal Help

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of credit reporting errors. Contact us for a free legal evaluation of your credit reports and dispute correspondence, and determine whether your consumer rights have been violated.

A key aspect of financial wellness is to

A key aspect of financial wellness is to  It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time.

It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time.

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken.

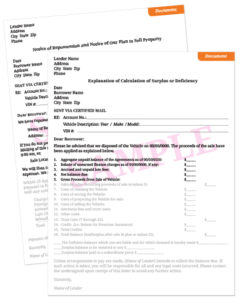

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken. Notice of Intent to Sell Property

Notice of Intent to Sell Property It may seem easier to get a loan for the car of your dreams these days, but more people are falling behind on payments and becoming delinquent on their loans. When it becomes easier to get an auto loan, auto loan delinquencies are more common.

It may seem easier to get a loan for the car of your dreams these days, but more people are falling behind on payments and becoming delinquent on their loans. When it becomes easier to get an auto loan, auto loan delinquencies are more common. Once delinquent, the lender may be able to repossess the vehicle without warning. If you think your

Once delinquent, the lender may be able to repossess the vehicle without warning. If you think your  If the lender has reported your payment history inaccurately, send

If the lender has reported your payment history inaccurately, send  Flitter Milz is a nationally recognized consumer protection law firm that represents consumers who have had a vehicle repossessed.

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers who have had a vehicle repossessed.