Pictured: Attorney Joe Solseng, Clients Jay & Carmen Seda, Attorneys Andy Milz & Dave Ricci

Pictured: Attorney Joe Solseng, Clients Jay & Carmen Seda, Attorneys Andy Milz & Dave Ricci

ATLANTIC CITY, N.J., Oct. 6, 2022 /PRNewswire/ — A Superior Court jury in New Jersey decided in favor of consumers deceived by timeshare seller FantaSea Resorts, awarding the plaintiffs a $1,069,285 verdict for the Atlantic City resort’s intentionally deceptive sales practices. The victory for consumers was championed by Schroeter Goldmark & Bender along with partners, Flitter Milz, PC and the Law Office of David Ricci.

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape.

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape.

“FantaSea stacked the deck against these families from the start,” said Joe Solseng, attorney with Schroeter Goldmark & Bender. “We’re grateful for the jury’s hard work and their willingness to hold FantaSea accountable for its systemic lies and deception, which turned a promised fantasy into a nightmare.”

In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

FantaSea, a participant in the Resort Owner’s Coalition (ROC) of the American Resort Development Association (ARDA) whose properties include its Flagship, Atlantic Palace and La Sammana resorts, also misled consumer plaintiffs into believing that their purchase was a real estate investment that would increase in value over time. Instead, plaintiffs in the suit found that they were not only unable to sell their timeshare purchase but that it had effectively no resale value.

“FantaSea Resorts had every opportunity to change its deceptive practices and comply with consumer protection laws before these plaintiffs were forced to bring this lawsuit against them. These families simply wanted out of these oppressive contracts, but FantaSea doubled down on their deception and made these families bring their case to trial. We hope this verdict sends a message that fraud of this nature won’t be tolerated,” said attorney Andrew Milz with Cherry Hill, New Jersey-based law firm Flitter Milz, PC.

“FantaSea Resorts had every opportunity to change its deceptive practices and comply with consumer protection laws before these plaintiffs were forced to bring this lawsuit against them. These families simply wanted out of these oppressive contracts, but FantaSea doubled down on their deception and made these families bring their case to trial. We hope this verdict sends a message that fraud of this nature won’t be tolerated,” said attorney Andrew Milz with Cherry Hill, New Jersey-based law firm Flitter Milz, PC.

FantaSea Resorts admitted to committing multiple violations throughout the sales process by failing to inform buyers of required legal disclosures and withholding important documents that revealed details about the timeshare until after the buyer had signed a purchase and sale agreement.

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than $17,000 for five one-week stays throughout the decade. A non-owner would pay just $3,965 for those same five stays. Even if the plaintiff continued to use her timeshare after her 10-year mortgage was paid off, it would take more than 150 years to break even with the non-owner. Another plaintiff testified at trial that it would take him 168 years to break even with a non-owner. Pictured above: Attorneys Joe Solseng (l), Andy Milz (r), & Clients Brian & Jenny Roward

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than $17,000 for five one-week stays throughout the decade. A non-owner would pay just $3,965 for those same five stays. Even if the plaintiff continued to use her timeshare after her 10-year mortgage was paid off, it would take more than 150 years to break even with the non-owner. Another plaintiff testified at trial that it would take him 168 years to break even with a non-owner. Pictured above: Attorneys Joe Solseng (l), Andy Milz (r), & Clients Brian & Jenny Roward

“What’s concerning for consumers is that business models like these, that are intentionally built to take advantage of good people, are not unique to FantaSea – and in fact, there are many resorts in the timeshare space that are even more egregious in their deceptive practices,” Solseng said. “I don’t recommend that anyone attend a timeshare presentation, no matter how much they entice you with gifts.”

Solseng added, “FantaSea and certain other ARDA timeshare outfits often use the word ‘Vacation Ownership’ so as to not call it a timeshare. But it’s a timeshare through and through, and the so-called vacation ownership can quickly turn into a vacation nightmare. We hope that the jury’s verdict and nullification of these FantaSea contracts will help other FantaSea timeshare owners and their lawyers. We hope this verdict is a way forward for plaintiff’s lawyers across the country to help timeshare consumers who are in the same position our clients were.”

About Plaintiffs Counsel

Flitter Milz, P.C.

Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Founded in 1969, Schroeter Goldmark & Bender (SGB) is a nationally recognized law firm based in Seattle that holds the most powerful companies, government agencies, and people accountable for their wrongdoing. SGB focuses on representing individuals in consumer protection cases, along with injured persons in aviation, asbestos and mesothelioma, catastrophic injury, brain/spinal cord injury, medical malpractice, unsafe products, wrongful death, sexual assault and harassment, as well as individual and class action employment cases. The firm believes the law is a force of good and is committed to achieving justice for people who have been harmed.

Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

Flitter Milz was presented with the Equal Justice Award in recognition of support to legal aid programs that allow low-income consumers to seek economic justice.

Flitter Milz was presented with the Equal Justice Award in recognition of support to legal aid programs that allow low-income consumers to seek economic justice. Cary Flitter was honored in May 2022 at the Fête 4 Justice hosted by Legal Aid of Southeastern Pennsylvania for his continued support of their mission to provide free civil legal aid to low-income consumers in Bucks, Chester, Delaware and Montgomery counties which surround Philadelphia, Pennsylvania.

Cary Flitter was honored in May 2022 at the Fête 4 Justice hosted by Legal Aid of Southeastern Pennsylvania for his continued support of their mission to provide free civil legal aid to low-income consumers in Bucks, Chester, Delaware and Montgomery counties which surround Philadelphia, Pennsylvania. Philadelphia Legal Assistance — Jubilee for Justice

Philadelphia Legal Assistance — Jubilee for Justice Flitter Milz represents people in individual and class action lawsuits with legal problems involving consumer credit transactions. Our attorneys evaluate whether a consumer’s rights have been violated — at no cost to the consumer — in matters related to credit reporting accuracy and privacy violations, wrongful vehicle repossessions, abuse from debt collectors, and consumer frauds, such as solar panel sales fraud.

Flitter Milz represents people in individual and class action lawsuits with legal problems involving consumer credit transactions. Our attorneys evaluate whether a consumer’s rights have been violated — at no cost to the consumer — in matters related to credit reporting accuracy and privacy violations, wrongful vehicle repossessions, abuse from debt collectors, and consumer frauds, such as solar panel sales fraud.  Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future.

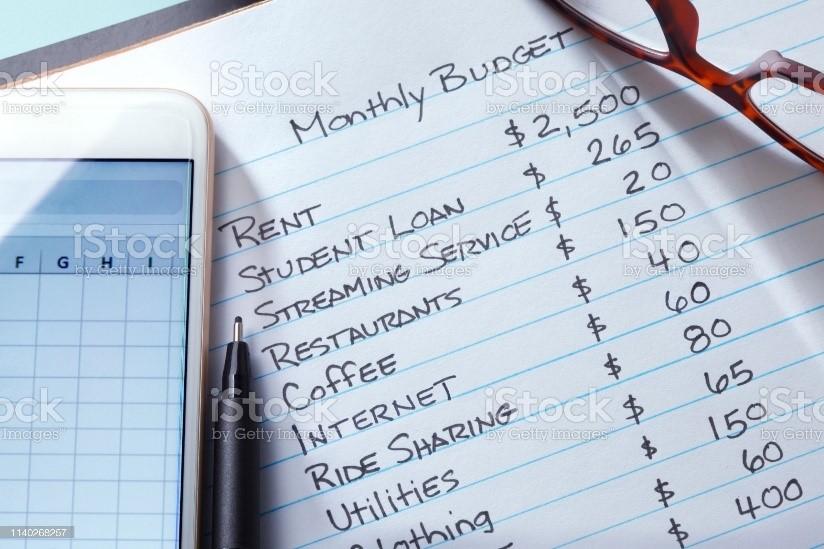

Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future. 1. Obtain Current Credit Reports

1. Obtain Current Credit Reports If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense.

If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense. Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,

Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,