If you’re going through financial hardship or a difficult life event, it can be challenging to keep up with your car loan payments. Your vehicle is collateral, or your pledge to a lender that you’ll repay the loan. If you default on the terms of your loan agreement, the lender may choose to repossess your vehicle. They’re not required to contact you before the repossession.

If your car was recently repossessed, you may be wondering what happens next. Do you still owe the payments that you missed on your loan? Do you still owe the full balance after your car is sold?

What happens after a repossession?

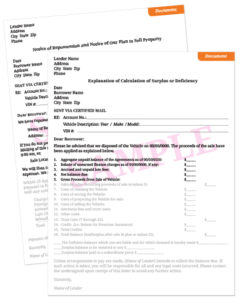

After your vehicle is repossessed, the lender will typically send a Repossession Notice, frequently called a Notice of Intent to Sell Property. This letter confirms that your vehicle was repossessed and tells you how to get the vehicle back. It also tells you when and where your vehicle will be sold or auctioned.

After your vehicle is repossessed, the lender will typically send a Repossession Notice, frequently called a Notice of Intent to Sell Property. This letter confirms that your vehicle was repossessed and tells you how to get the vehicle back. It also tells you when and where your vehicle will be sold or auctioned.

Once the vehicle has been sold, the lender will send a Deficiency Notice. This letter shows the selling price of your vehicle, and deducts that amount from the balance owed on your loan. Often charges for storage and a repossession fee are added to the balance claimed by the lender. These charges are added to the total balance owed in order to satisfy the loan. You’re required to pay this outstanding balance under the terms of your loan agreement.

Collection of a Deficient Balance

The lender may contact you directly to collect the deficient balance owed on your car loan. Or, they may assign the collection to a debt collector, and you may begin to receive collection calls or letters. Once a debt collector contact you, you have rights to be treated fairly.

The Fair Debt Collection Practices Act (FDCPA) is the federal law that protects consumers from abusive collection practices. When the collection agency, or law firm collector, violates the law, the consumer may pursue a lawsuit against the collector — whether or not a deficient balance is owed.

Seek Legal Help

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of wrongful repossession and debt collection tactics. To evaluate whether your consumer rights were violated, Contact us for a free evaluation of your case. Whether you fell behind on car loan payments or not, you have rights against the lender or repo agent that may have wrongfully repossessed your vehicle. (Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of wrongful repossession and debt collection tactics. To evaluate whether your consumer rights were violated, Contact us for a free evaluation of your case. Whether you fell behind on car loan payments or not, you have rights against the lender or repo agent that may have wrongfully repossessed your vehicle. (Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).