A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken.

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken.

Protect Your Personal Items BEFORE the

Repossession

If you suspect that your car may be repossessed, remove all personal items from the vehicle, glove box, and trunk. This includes:

- All car purchase and loan documents. Keep these documents in a safe place.

- Work-related items, such as briefcases, laptops, or tools.

- Family-related items, such as personal mail, car seats, school work, or clothing.

Follow these steps prior to the repossession.

When Can a Lender Repossess a Vehicle?

When you sign a contract to finance a vehicle, the car is considered collateral. This means that the bank or credit union has the right to take back the vehicle if the borrower defaults on the terms of the contract.

Terms for default include missed payments, partial payments, or late payments, or lapse in auto insurance for unpaid premiums. Specific terms for default are listed in the loan agreement that you signed.

How to Get Personal Items Back AFTER a Repossession

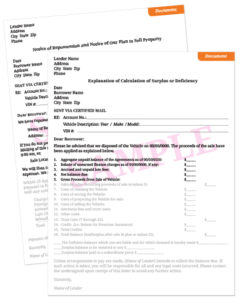

Notice of Intent to Sell Property

Notice of Intent to Sell Property

After a vehicle has been repossessed, the lender will send a letter to the borrower that details terms to retrieve the vehicle. This letter, frequently called a Notice of Intent to Sell Property, states the location of the repossessed car so that the borrower knows who to contact to reclaim any personal items.

Retrieve Personal Property

You may be unable to retrieve attached fixtures, such as a stereo or rims, but any loose items are yours to claim. The borrower typically has 30 days to get their possessions from the car.

Deficiency Notice

Once the vehicle is sold, the lender is to send a letter to the borrower which confirms the selling price and then a calculation of any remaining balance claimed to be owed to satisfy the loan.

Damage to Your Personal Property

When the repo agent arrives to take your vehicle, you may request to remove your personal items. Car repossession laws prohibit repo agents from damaging your personal property.

If your property is damaged, get the name of the repo agent, repossession company name, phone number, and license plate number of the repo truck. Inform the lender of any damage caused by the repo agent. As well, contact the police to file a report. Be sure to take photographs of the damaged property, and gather witness statements.

Seek Legal Advice

Flitter Milz is knowledgeable about the laws governing the repossession of cars, trucks, motorcycles, boats and RVs. If your vehicle has been repossessed, Contact Us for a NO COST review and evaluation of whether your consumer rights have been violated.

Flitter Milz is knowledgeable about the laws governing the repossession of cars, trucks, motorcycles, boats and RVs. If your vehicle has been repossessed, Contact Us for a NO COST review and evaluation of whether your consumer rights have been violated.