Consumer Reports, February 3, 2021

Why the Pandemic May Be Hurting Your Credit Score By Lisa L. Gill

https://www.consumerreports.org/credit-scores-reports/why-the-pandemic-may-be-hurting-your-credit-score/

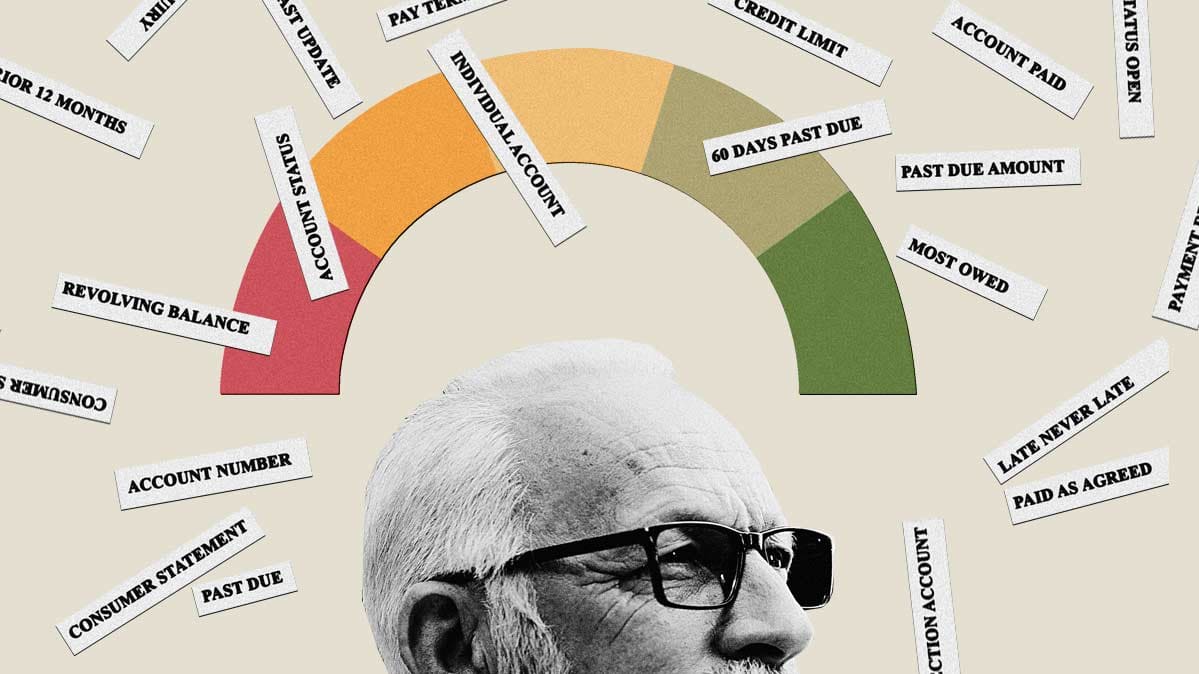

Illustration: Lincoln Agnew

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Protect your credit.

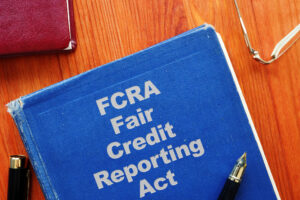

Don’t let inaccurate information on your credit report keep you from getting the loan you want. The Fair Credit Reporting Act, is the federal law that helps ensure the accuracy of information on credit reports. It is the duty of credit furnishers and the credit bureaus to report accurate information. If reported information is disputed by the consumer, the bureau and/or creditor must investigate the claim and correct the error. Consumers must take steps to keep accurate credit reports.

1. Review your Credit Report Regularly

Consumers are entitled to receive one free credit report every twelve months from each of the Big 3 credit bureaus – Transunion, Experian and Equifax. Consumers must provide two forms of identification, such as a current driver’s license, pay stub or utility bill, to obtain a report.

Consumers are entitled to receive one free credit report every twelve months from each of the Big 3 credit bureaus – Transunion, Experian and Equifax. Consumers must provide two forms of identification, such as a current driver’s license, pay stub or utility bill, to obtain a report.

2. Send written dispute to address errors with the Credit Bureaus

If you notice errors on your credit reports, you must send a written dispute to the bureau. The letter should clearly identify the error and state why the listing should be updated or removed. Errors that remain on a consumer’s report could violate the consumer’s right under the Fair Credit Reporting Act.

If you notice errors on your credit reports, you must send a written dispute to the bureau. The letter should clearly identify the error and state why the listing should be updated or removed. Errors that remain on a consumer’s report could violate the consumer’s right under the Fair Credit Reporting Act.

3. Seek Legal Help from a Qualified Consumer Protection Law Firm

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters where the credit bureaus or credit furnishers have continued to report errors on credit reports. Contact Us for a no cost legal review to determine whether your consumer rights have been violated.

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters where the credit bureaus or credit furnishers have continued to report errors on credit reports. Contact Us for a no cost legal review to determine whether your consumer rights have been violated.

Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature.

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature. Consumers must

Consumers must

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters involving credit reporting accuracy and privacy.

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters involving credit reporting accuracy and privacy.

J

J

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year.

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year. 4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should

4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should  One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter.

One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter. The Fair Credit Reporting Act

The Fair Credit Reporting Act  Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

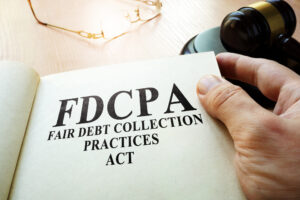

The holiday shopping season is, under normal circumstances, a big stressor on the wallet. But this year proposes to be even more difficult than in years past, given that the global COVID-19 pandemic has led to massive job losses and financial hardships for people far and wide. Although the federal

The holiday shopping season is, under normal circumstances, a big stressor on the wallet. But this year proposes to be even more difficult than in years past, given that the global COVID-19 pandemic has led to massive job losses and financial hardships for people far and wide. Although the federal  The danger in over-spending comes when that monthly bill is due, and you are still unable to come up with the cash to pay it off. Not paying

The danger in over-spending comes when that monthly bill is due, and you are still unable to come up with the cash to pay it off. Not paying  Using a credit card makes it easy to over-spend, especially during the holidays. The freedom of making purchases with a credit card today, could make it difficult to pay the bill the following month if purchases get out of hand.

Using a credit card makes it easy to over-spend, especially during the holidays. The freedom of making purchases with a credit card today, could make it difficult to pay the bill the following month if purchases get out of hand. Credit reports

Credit reports Flitter Milz is a nationally recognized consumer protection law firm that represents people with credit reporting accuracy and privacy issues, contact from abusive debt collectors and wrongful repossession. If you are someone who has suffered a hardship during the pandemic and feel as though your consumer rights have been violated by the credit bureaus, a lender or debt collector,

Flitter Milz is a nationally recognized consumer protection law firm that represents people with credit reporting accuracy and privacy issues, contact from abusive debt collectors and wrongful repossession. If you are someone who has suffered a hardship during the pandemic and feel as though your consumer rights have been violated by the credit bureaus, a lender or debt collector,

Flitter Milz is a nationally recognized consumer protection law firm experienced in representing consumers who have suffered from abusive debt collection practices and credit reporting errors.

Flitter Milz is a nationally recognized consumer protection law firm experienced in representing consumers who have suffered from abusive debt collection practices and credit reporting errors.