Consumer Reports, February 3, 2021

Why the Pandemic May Be Hurting Your Credit Score By Lisa L. Gill

https://www.consumerreports.org/credit-scores-reports/why-the-pandemic-may-be-hurting-your-credit-score/

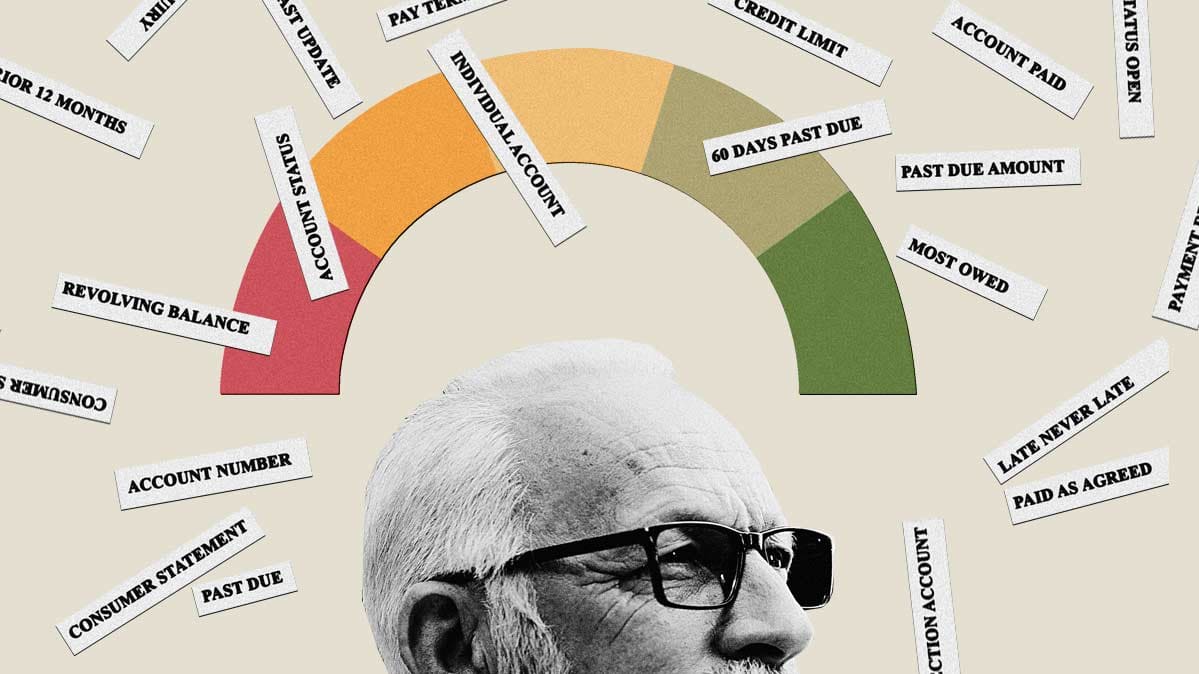

Illustration: Lincoln Agnew

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Protect your credit.

Don’t let inaccurate information on your credit report keep you from getting the loan you want. The Fair Credit Reporting Act, is the federal law that helps ensure the accuracy of information on credit reports. It is the duty of credit furnishers and the credit bureaus to report accurate information. If reported information is disputed by the consumer, the bureau and/or creditor must investigate the claim and correct the error. Consumers must take steps to keep accurate credit reports.

1. Review your Credit Report Regularly

Consumers are entitled to receive one free credit report every twelve months from each of the Big 3 credit bureaus – Transunion, Experian and Equifax. Consumers must provide two forms of identification, such as a current driver’s license, pay stub or utility bill, to obtain a report.

Consumers are entitled to receive one free credit report every twelve months from each of the Big 3 credit bureaus – Transunion, Experian and Equifax. Consumers must provide two forms of identification, such as a current driver’s license, pay stub or utility bill, to obtain a report.

2. Send written dispute to address errors with the Credit Bureaus

If you notice errors on your credit reports, you must send a written dispute to the bureau. The letter should clearly identify the error and state why the listing should be updated or removed. Errors that remain on a consumer’s report could violate the consumer’s right under the Fair Credit Reporting Act.

If you notice errors on your credit reports, you must send a written dispute to the bureau. The letter should clearly identify the error and state why the listing should be updated or removed. Errors that remain on a consumer’s report could violate the consumer’s right under the Fair Credit Reporting Act.

3. Seek Legal Help from a Qualified Consumer Protection Law Firm

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters where the credit bureaus or credit furnishers have continued to report errors on credit reports. Contact Us for a no cost legal review to determine whether your consumer rights have been violated.

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters where the credit bureaus or credit furnishers have continued to report errors on credit reports. Contact Us for a no cost legal review to determine whether your consumer rights have been violated.

Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).