CARS TRUCKS MOTORCYCLES BOATS RVs

CARS TRUCKS MOTORCYCLES BOATS RVs

Flitter Milz is the authority in representing victims of wrongful repossessions by banks, credit unions, financial institutions and their repossession agents.

Borrowers understand that their vehicles can be repossessed if there’s been a default, such as missed or late payments, a lapse in auto insurance, or other cause. However, lenders must follow the law when a vehicle is repossessed.

Whether you missed payments on your auto loan or not, your consumer rights may have been violated. Our firm will evaluate the repossession of your vehicle at no cost.

After repossession, ask yourself these questions:

Did the repo agent act abusively or damage property?

Did the repo agent act abusively or damage property?

Repo agents can’t threaten or use physical force to take your vehicle, or enter your fenced property without your permission.

Did the police come and assist the repo agent with the repossession?

Did the police come and assist the repo agent with the repossession?

The police may be contacted by the repo agent or borrower during a vehicle repossession. Upon arrival at the scene, they are to keep the peace only, or to protect everyone from harm.

Did you receive proper notices from your lender after the repossession?

Did you receive proper notices from your lender after the repossession?

After repossession, the lender is required to send a Repossession Notice which states terms to get the vehicle back and timeframes for the borrower to act.

Was your vehicle repossessed within the past six years?

Was your vehicle repossessed within the past six years?

Each state has a different statute of limitations on car repossession debt. After the statute of limitations has passed on your debt, debtors and collectors can still contact you. However, they can no longer bring, or threaten to bring, legal action in an effort to collect the debt.

Collection of the deficient balance owed on your auto loan?

Collection of the deficient balance owed on your auto loan?

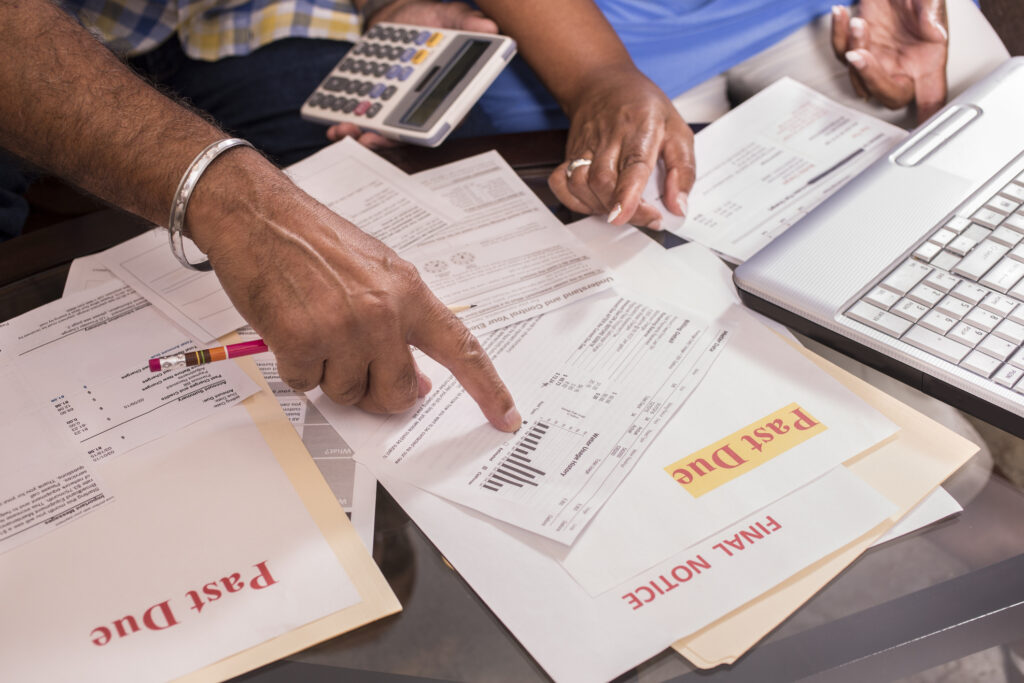

A Deficiency letter will be sent to the borrower after the vehicle is sold. This letter shows a calculation of any remaining balance owed to satisfy the loan. The lender may assign collection of this balance to a debt collector.

Did the lender file a lawsuit to collect the deficient balance?

Did the lender file a lawsuit to collect the deficient balance?

The lender may choose to file a lawsuit to collect the deficient balance owed on an auto loan.

Credit Reporting Auto Loans

After a vehicle repossession, the borrower should obtain current copies of his or her credit reports from Transunion, Experian and Equifax to view accuracy of information related to the repossession. Incorrect information may have an impact on approval for new credit applications.

Contact Experienced Consumer Lawyers

Flitter Milz attorneys know repossession law and can protect borrowers from illegal tactics used by banks, credit unions and financial institutions. We represent consumers in cases without filing bankruptcy.

Flitter Milz attorneys know repossession law and can protect borrowers from illegal tactics used by banks, credit unions and financial institutions. We represent consumers in cases without filing bankruptcy.

Contact Us for a no cost legal evaluation of your car, truck, motorcycle, boat or RV.

Phone: 888-668-1225 Email: consumers@consumerslaw.com

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle.

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle. can’t meet the terms agreed upon in their auto loan agreement.

can’t meet the terms agreed upon in their auto loan agreement. First, after taking back the vehicle, the lender will send a repossession notice, or

First, after taking back the vehicle, the lender will send a repossession notice, or

Flitter Milz is a nationally recognized consumer protection law firm that pursues matters against banks, credit unions and financial institutions for the wrongful repossession of cars, truck, motorcycles, RVs and boats.

Flitter Milz is a nationally recognized consumer protection law firm that pursues matters against banks, credit unions and financial institutions for the wrongful repossession of cars, truck, motorcycles, RVs and boats.

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of improper vehicle repossessions. If you think your consumer rights may have been violated by the lender or repo agent,

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of improper vehicle repossessions. If you think your consumer rights may have been violated by the lender or repo agent,  Vehicle repossessions are worrisome and stressful enough, but what happens when the lender files a lawsuit against you after the repossession? Learn about what a deficiency lawsuit is, and what you should do if you’re being sued.

Vehicle repossessions are worrisome and stressful enough, but what happens when the lender files a lawsuit against you after the repossession? Learn about what a deficiency lawsuit is, and what you should do if you’re being sued. A qualified consumer rights attorney can evaluate all collection contact for compliance with the Fair Debt Collection Practices Act. If the collector’s tactics have violated the law, you can sue the collector, even though the deficient balance may be owed.

A qualified consumer rights attorney can evaluate all collection contact for compliance with the Fair Debt Collection Practices Act. If the collector’s tactics have violated the law, you can sue the collector, even though the deficient balance may be owed. A qualified consumer rights attorney can evaluate all collection contact for compliance with

A qualified consumer rights attorney can evaluate all collection contact for compliance with Contact Flitter Milz, a consumer rights law

Contact Flitter Milz, a consumer rights law An unexpected occurrence like illness or loss of employment can leave you struggling to pay bills on time. If you are unable to pay your car loan on time, the lender may choose to repossess your vehicle.

An unexpected occurrence like illness or loss of employment can leave you struggling to pay bills on time. If you are unable to pay your car loan on time, the lender may choose to repossess your vehicle.