Credit reports contain a wealth of personally identifying financial information and offer a peek into a consumer’s current, and past, financial status. The privacy of these reports, and the accuracy of their information, is critical to consumers. Prospective lenders, employers, landlords and utility companies may need to request access to reports to determine whether to extend credit, offer a job or a place to live.

The Fair Credit Reporting Act is the federal law that governs how credit information is used and distributed. Consumers have the right to see their reports, who may have accessed it, and dispute any errors that appear and get them corrected.

Who can access your credit report?

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature.

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature.

Periodically, lenders with whom you already have credit accounts are also given permission to access your credit reports as part of their account review process. These inquiries, however, would not negatively impact your credit scores.

In some instances, the government is also permitted to access your credit reports, specifically if responding to a court order or subpoena, or when reviewing your eligibility to certain governmental benefits.

Monitor your Credit Reports for Privacy and Accuracy

Consumers must monitor their reports, not only for accuracy, but to see who has accessed his or her credit file. The three main credit bureaus, Transunion, Experian and Equifax, are required to keep track of instances in which credit reports are accessed, and who is accessing them.

Consumers must monitor their reports, not only for accuracy, but to see who has accessed his or her credit file. The three main credit bureaus, Transunion, Experian and Equifax, are required to keep track of instances in which credit reports are accessed, and who is accessing them.

Impermissible Credit Pulls include:

- A sales company pulling a credit report before a consumer has given an OK.

- A creditor that pulls a report after debt is discharged in bankruptcy.

- A creditor pulling a report after the account has been closed.

- A potential employer pulling a report during the interview process.

- A potential landlord pulling a credit report without permission.

What is ‘Hard’ v. ‘Soft’ Credit Inquiry

In general, two types of credit inquiries exist: a hard inquiry and a soft inquiry.

-

-

- A ‘hard’ inquiry, is when a lender with whom you’re applying for credit reviews your credit reports within the scope of their process to decide whether to approve or decline the new credit application. Too many hard inquiries on one’s credit report is not a good sign to lenders, since it signals that you either have too many accounts open, that you are having financial difficulty, or that you are at risk of overspending.

- A ‘soft’ inquiry, is when a lender or credit card company reviews your credit reports as part of a preapproval process for some type of promotional offer. The important thing to remember is that a ‘soft’ credit pull will not hurt your credit score.

-

How do I know if someone accessed my report?

Credit reports are divided in to sections, such as: Personal Information, Public Records, Account Information, Satisfactory Accounts, Closed Accounts, Collections, and Inquiries. The Inquiry section lists all individuals or companies that have accessed the consumer’s report and includes the name of who inquired, the date of the inquiry, the type of business and the businesses’ contact information. The consumer may write to the address of the inquirer to request an explanation for the inquiry.

How do you get your Credit Reports?

All consumers are entitled to one free credit report every 12 months from TransUnion, Experian and Equifax. Often, the credit bureau will request two forms of identification with your request which confirm who you are and where you live. You may choose to submit a current driver’s license, utility bill or pay stub. Consumers that wish to view their reports more often could enroll in a credit monitoring service, or pay to receive additional individual reports from each bureau.

3 Options to obtain credit reports:

-

-

- Write to the credit bureau.

- Visit the website: annualcreditreport.com.

- Call toll-free –877-322-8228.

-

Have you become a victim of Identity Theft?

Periodic reviews of credit files can help ensure that no fraudulent activity has occurred with your financial information. By checking your credit reports frequently, you can see whether credit applications or unfamiliar accounts were opened in your name, or that your file was accessed without permission. If you discover that you may be an identity theft victim, place a fraud alert on your credit report to alert the bureaus that you must be contacted when credit applications are filed.

How do you dispute Credit Reporting Errors?

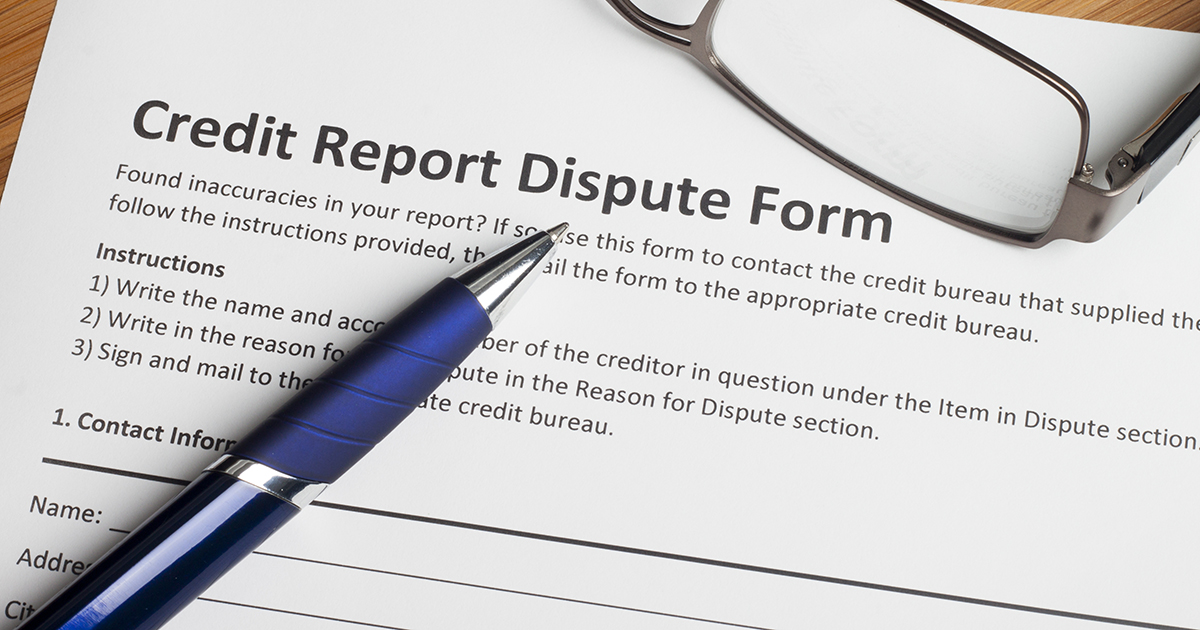

Credit reports must be accurate. When you discover errors or listings that are unfamiliar, a written dispute letter must be sent to the credit bureau. The letter must clearly identify the error and state the action required to correct the problem. In addition, the bureaus must receive documents which support the claim for correction.

Get help from a Qualified Consumer Law Firm

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters involving credit reporting accuracy and privacy. Contact us for a no cost evaluation of whether your consumer rights have been violated.

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters involving credit reporting accuracy and privacy. Contact us for a no cost evaluation of whether your consumer rights have been violated.

J

J

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year.

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year. 4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should

4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should  One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter.

One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter. The Fair Credit Reporting Act

The Fair Credit Reporting Act  Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

Flitter Milz is a nationally recognized consumer protection law firm that assists victims of identity theft that have suffered from credit report harm, abusive debt collectors and wrongful vehicle repossessions by aggressive lenders and repo agents.

Flitter Milz is a nationally recognized consumer protection law firm that assists victims of identity theft that have suffered from credit report harm, abusive debt collectors and wrongful vehicle repossessions by aggressive lenders and repo agents.