Understand credit scores and credit reports

Understand credit scores and credit reports

Credit is part of your financial power. It plays a crucial role in enabling us to get the things we may need or want, such as homes, vehicles or educations. However, many consumers don’t take an active role in managing and monitoring their credit scores or credit files. There is a common misconception that your “credit score” is your credit report. It is important to understand the difference.

What is a credit score?

What is a credit score?

A credit score is a number that predicts how likely you are to pay back a loan on time. Information that appears on your credit report is used in a scoring model, which is a mathematical formula, to create the score. Depending on the specific data used to calculate a score, the actual credit score number can vary from one scoring model to another. Most credit scores range from 300 – 850. Higher scores make it easier to qualify for a loan and may result in better terms, such as interest rates and length of the loan.

Seeking Credit

When consumers seek credit, whether it be for a mortgage, auto loan, credit card, or another type of credit product, the lender will request access to the consumer’s  credit and obtain copies of his or her credit reports and credit scores.

credit and obtain copies of his or her credit reports and credit scores.

This information will assist the lender in determining whether to extend credit, and if so, the interest rate on the loan or credit card, and the credit limit.

Here are some guidelines that may help you to get and keep a good credit score

- Pay your loans in full and on time.

- Keep credit balances low in relation to the full credit limit

- Develop good payment history over time

- Only apply for the credit you need

- Review your credit reports regularly

What is a Credit Report?

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you. Shall I give you a job offer? Rent you an apartment?

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you. Shall I give you a job offer? Rent you an apartment?

Many people use apps, such as CreditKarma or Credit Sesame, to get a sense of where their credit stands. But these apps do not show your credit report. Instead, they give you only a superficial snapshot of the status of your accounts. They may not show the most up-to-date information about your credit file, which may reflect inaccurately reported missed payments from years ago. The only way you can see the most current information on your credit file is to obtain your credit report from one of the three main bureaus – Transunion, Experian and Equifax.

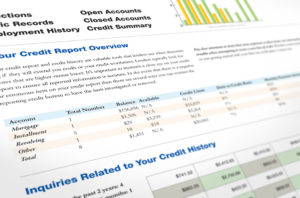

What type of information is on a Credit Report?

The type of information listed on credit reports can include:

Personal information:

Your name and name changes, current and former addresses, birth date, social security number and phone numbers.

Credit Accounts:

Name of creditor & account type, balance, payment history, credit limit &

date opened/closed.

Collection Accounts:

Credit accounts that have been assigned to a collection agency.

Public Records:

Liens, Foreclosures, Bankruptcies, Civil suits and Judgments

Hard Pull Inquiries:

Lenders that access a consumer’s credit file in the process of extending new credit.

Soft Pull Inquiries:

Businesses access consumer files for the purpose of extending a new

credit opportunity or service.

Check your credit reports for accuracy

Credit reports should be reviewed regularly for accuracy. When incorrect information appears on a credit report, the consumer must send a written dispute to the credit bureau. The dispute letter must clearly state the error that appears on the report and include documents that support the claim for correction. The bureaus have 30 days to respond in writing to the dispute. If the error is not corrected, the consumer may need to seek counsel from a qualified consumer protection lawyer.

How to Obtain a Credit Report?

Send a written request to the credit bureau

Consumers may obtain credit reports by writing to Transunion, Experian and Equifax. Your letter should include two forms of identification, such as a current driver’s license and utility bill. It may take about two weeks to receive your report through the mail. Click here for a template letter.

Request your report online:

During the COVID-19 pandemic, Transunion, Experian and Equifax are offering free weekly online credit reports through annualcreditreport.com, a website authorized under federal law that allows you to request free reports from each credit reporting agency every 12 months.

Seek Legal Help from Qualified Consumer Lawyers

Do you have errors on your credit reports? Problems getting credit?

Do you have errors on your credit reports? Problems getting credit?

Flitter Milz is a nationally recognized consumer protection law firm that evaluates matters involving credit reporting accuracy and privacy.

Contact us for a no cost legal evaluation of whether your consumer rights have been violated. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right)