It’s hard to argue with the convenience of a credit card. Credit provides you with flexibility when it comes to spending. Your card is always available to use regardless of when you expect your next paycheck. Owning a credit card and making timely payments also helps your credit because it shows lenders that you’re a trustworthy and responsible borrower.

It’s important to establish responsible spending habits early so that you don’t find yourself with significant amounts of debt later in life. Carrying a balance each month can make it difficult to stay on top of payments. Here are some credit spending tips that you should practice now to keep your finances healthy for your future.

Set a Budget

The perk of using a credit card is having the ability to spend money you may not necessarily have at the moment. But this can be a dangerous. It can lead to spending above your means. Create a reasonable spending budget for your card to ensure that you don’t overspend.

Pay the Balance in Full Each Month

Carrying a balance from month to month like so many consumers do isn’t ideal. Many cards have high interest rates, which make it even more difficult to keep up with payments every month. Set a goal to pay your balance in full and on time each month so that you don’t end up paying exorbitant late fees and interest.

Keep Your Credit Utilization Low

It’s never a good idea to max out a credit card. Your credit utilization plays a major factor in your credit score. Ideally, you don’t want to spend more than 30% of your credit limit. This means if you have a $1,000 credit limit on a card, you shouldn’t spend more than $300. If you have a higher budget and want to use your card more, pay the existing balance before it’s due to bring your available credit back to its full amount.

Find a Card with No Annual Fees

When you shop around for a new credit card, look for ones with lower interest rates, no annual fees, and useful perks. Many cards offer cash back on any amount that you spend with your card. Others offer travel perks like airline miles.

Pay Off Credit Card Debt

Get control over credit card debt as soon as possible. Making minimum payments will mean paying excessive amounts of interest over time and can make you feel as if you’ll never get out of debt. Cut your spending wherever you can so that you can focus on paying off your debt as quickly as possible.

Seek Free Legal Help

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of abusive collection tactics, credit reporting accuracy and privacy issues and wrongful vehicle repossessions. Contact Us with your consumer credit concerns. There is no cost for the consultation.

Shopping for a new vehicle can be overwhelming on its own without even considering the auto loan application process. But if you don’t take the time to research and compare auto loans, you may end up with a bad deal.

Shopping for a new vehicle can be overwhelming on its own without even considering the auto loan application process. But if you don’t take the time to research and compare auto loans, you may end up with a bad deal.

Flitter Milz is a consumer protection law firm that represents victims of vehicle repossession. If a borrower defaults on a bad auto loan and the vehicle is repossessed, Flitter Milz will evaluate whether the lender violated the borrower’s consumer rights. If your vehicle has been repossessed in the past six years,

Flitter Milz is a consumer protection law firm that represents victims of vehicle repossession. If a borrower defaults on a bad auto loan and the vehicle is repossessed, Flitter Milz will evaluate whether the lender violated the borrower’s consumer rights. If your vehicle has been repossessed in the past six years,  Before applying for any new line of credit, it’s good practice to

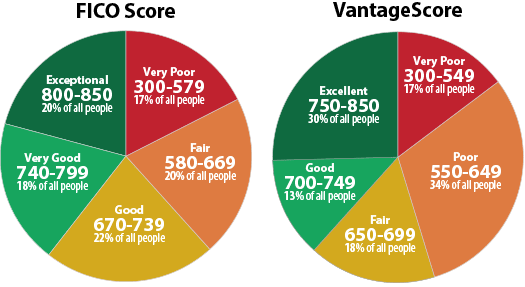

Before applying for any new line of credit, it’s good practice to  However, credit scores that fall in the non-prime (620-679) and subprime (550-619) ranges may not necessarily indicate that you aren’t eligible for a reasonable interest rate. Lenders often use different tiers according to their own business needs to assess creditworthiness.

However, credit scores that fall in the non-prime (620-679) and subprime (550-619) ranges may not necessarily indicate that you aren’t eligible for a reasonable interest rate. Lenders often use different tiers according to their own business needs to assess creditworthiness. Flitter Milz is a consumer protection law firm that pursues matters against lenders, debt collectors and the credit bureaus. If a lender wrongfully repossesses a vehicle, a debt collector is abusive or the credit bureaus report information inaccurately, the consumer may have a lawsuit to pursue. For a no cost legal evaluation,

Flitter Milz is a consumer protection law firm that pursues matters against lenders, debt collectors and the credit bureaus. If a lender wrongfully repossesses a vehicle, a debt collector is abusive or the credit bureaus report information inaccurately, the consumer may have a lawsuit to pursue. For a no cost legal evaluation,

When you need to secure a loan for the purchase of your new vehicle,

When you need to secure a loan for the purchase of your new vehicle,

Before agreeing to a loan with one of these dealerships, be sure to shop around and see if there is a bank, credit union or other lender who is willing to loan to you. An auto loan with high interest rates, like those that typically come from buy here – pay here dealerships, may not be worth it; the cost of the loan could outweigh the benefit of purchasing the vehicle. Learn more about

Before agreeing to a loan with one of these dealerships, be sure to shop around and see if there is a bank, credit union or other lender who is willing to loan to you. An auto loan with high interest rates, like those that typically come from buy here – pay here dealerships, may not be worth it; the cost of the loan could outweigh the benefit of purchasing the vehicle. Learn more about  Before visiting the car dealership, it’s important to

Before visiting the car dealership, it’s important to