The addition of solar panels to your home may sound like a great idea. From lower energy bills to a reduced carbon footprint, it’s the “green” thing to do. However, you must assess whether it is the right decision for your home and your budget.

Consumers considering solar energy must take time to research the pros and cons of solar power, and then investigate the companies that sell, install and finance the panels. Do not feel pressured in to signing a contract for solar panels. Informed decisions make the best decisions.

Is the Solar Salesperson being truthful?

Many times, the sales process begins with an unsolicited call at your door. You’re greeted by a salesperson that is personable and knowledgeable about the benefits of solar power. They’re professional and trained to earn your trust. Most homeowners are persuaded with promises of free panels, reduced costs for energy, and low maintenance.

How did I end up in a contract for solar panels?

Maybe you aren’t completely sold on solar panels, and simply want more information about switching to solar power. Beware. At this point of the presentation, the salesperson may casually suggest that you submit an application, just to see whether or not you qualify for solar panels. You’ll be offered an iPad or tablet to sign, and be told not to worry because you’ll receive copies of all documents by email.

Maybe you aren’t completely sold on solar panels, and simply want more information about switching to solar power. Beware. At this point of the presentation, the salesperson may casually suggest that you submit an application, just to see whether or not you qualify for solar panels. You’ll be offered an iPad or tablet to sign, and be told not to worry because you’ll receive copies of all documents by email.

Dangers of E-Signing

Placing your signature or initials on an iPad, tablet, or phone may seem easy. However, your electronic signature or initials may be copied and affixed to a contract or other forms that you did not intend.

Placing your signature or initials on an iPad, tablet, or phone may seem easy. However, your electronic signature or initials may be copied and affixed to a contract or other forms that you did not intend.

A signature on a contractual document or other written agreement, demonstrates that a party has read, understood and consents to the terms and conditions of the contract.

Before signing anything, insist on a paper copy of every document in advance. Take time to read each document. If the terms do not make sense, consult an attorney.

Written Permission to Access Credit Reports

Solar companies rely on financing to make solar panels available to consumers. Credit reports are accessed to evaluate a potential customer’s creditworthiness. The consumer must provide written permission for the solar company to obtain these reports.

Solar companies rely on financing to make solar panels available to consumers. Credit reports are accessed to evaluate a potential customer’s creditworthiness. The consumer must provide written permission for the solar company to obtain these reports.

If you do not want your credit accessed, do not provide your E-signature on an electronic device. That signature could be copied to a credit request form. Credit files accessed without permission could be a violation to the consumer’s rights under the Fair Credit Reporting Act (FCRA). This federal law offers protections to consumers for the privacy and accuracy of their credit information.

Common Misrepresentations to the Consumer

Solar panels will be free.

Solar panels will be free.

Many salespeople tell consumers that solar panels are free. In most cases, they are not free; in fact, they can cost you $20,000 to $30,000, or more. And, you can be in a 20+ year contract to pay for the panels. As well, the consumer will pay for electricity that is produced by the panels, usually through a lease or power purchase agreement.

Tax rebates

Many times, the solar panel company may not want to sell you the panels. If you, the buyer, purchases the panels, you would receive the tax credit, not the solar company. If the solar company leases you panels and only promises to sell you the solar power, the solar sales company may receive the tax credit, not you, the homeowner.

Many times, the solar panel company may not want to sell you the panels. If you, the buyer, purchases the panels, you would receive the tax credit, not the solar company. If the solar company leases you panels and only promises to sell you the solar power, the solar sales company may receive the tax credit, not you, the homeowner.

Your Neighbors Are Doing It!

Your Neighbors Are Doing It!

A popular tactic used by solar salespeople to gain credibility is to mention that your neighbor signed the same contract as the one offered to you. Don’t feel pressured. Speak with your neighbor first and find out about his experience.

Four Important Steps to protect yourself from Scams:

- Research whether adding solar panels is right for you. You may wish to visit websites for the Federal Trade Commission, Consumer Financial Protection Bureau or the Department of Energy

- Evaluate the reputation of solar providers — Solar panels companies, installers and finance companies.

- Consult consumers who have entered solar panel contracts. Visit websites for the Better Business Bureau, your State Attorney General, Federal Trade Commission, or online consumer complaint forums.

- Review the solar panel contract. Understand the terms and financial obligation. Get answers to your questions. Once you sign, you may be on the hook for 20 years or more.

Seek Legal Help from a Qualified Consumer Law Firm

Flitter Milz is a nationally recognized consumer protection law firm that evaluates solar panel sales matters for potential violation of the consumer protection laws involving fraud, such as forged contracts, identity theft and credit reporting privacy violations. Contact Us for a no cost evaluation.

Flitter Milz is a nationally recognized consumer protection law firm that evaluates solar panel sales matters for potential violation of the consumer protection laws involving fraud, such as forged contracts, identity theft and credit reporting privacy violations. Contact Us for a no cost evaluation.

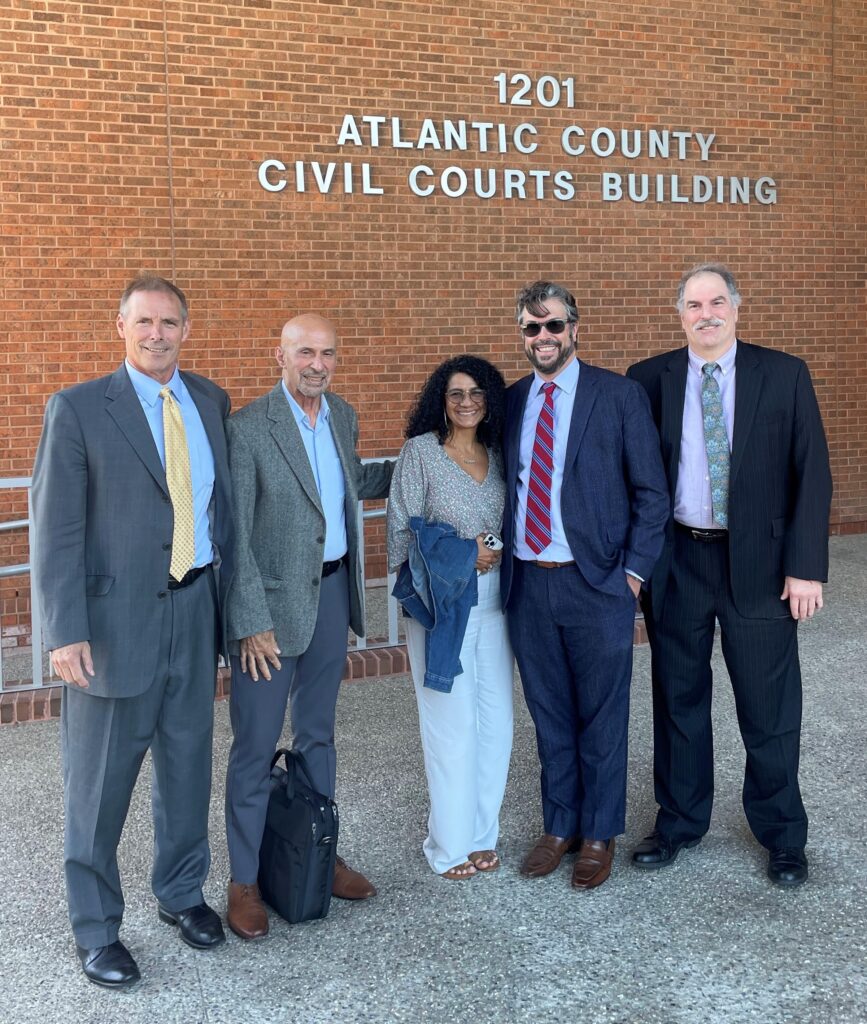

Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape.

The jury verdict will compensate a group of 19 plaintiffs whose consumer protection rights were violated by repeated misrepresentations throughout FantaSea Resort’s routine, deceptive sales practices. The jury agreed that FantaSea’s tactics left consumers with timeshare purchases they couldn’t use as described, with payments and rising maintenance fees they couldn’t escape. In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

In trial, FantaSea Resorts admitted to making knowingly false statements to lure potential buyers into binding timeshare sales agreements through a sales process that violated the New Jersey Real Estate Timeshare Act (RETA). According to court documents, FantaSea intentionally withheld important sales documents from the buyers until after they had completed the transaction, contrary to what they are legally required to do.

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than

What’s more, FantaSea’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non-owners, according to court documents. In one case, over the length of the plaintiff’s 10-year mortgage, she would pay more than  Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right).

Flitter Milz, PC, with offices in PA, NJ, and NY, is a nationally recognized leader in consumer protection law, with over 30 years’ experience in the field. The firm represents victims of finance fraud, illegal vehicle repossessions, unfair debt collection practices, credit report errors, civil rights abuses, and other consumer protection matters in individual and class action cases. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right). All it takes is someone with the same or similar name, birthdate, address, or other matching identifying information to have a stranger’s record inaccurately mixed with yours. Their DUI, their theft conviction, or their sex offence can then show up on YOUR report. It’s no surprise then that bad background checks for employment, rent, or security clearance can ruin someone’s livelihood and reputation in an instant.

All it takes is someone with the same or similar name, birthdate, address, or other matching identifying information to have a stranger’s record inaccurately mixed with yours. Their DUI, their theft conviction, or their sex offence can then show up on YOUR report. It’s no surprise then that bad background checks for employment, rent, or security clearance can ruin someone’s livelihood and reputation in an instant.

The Consumer Financial Protection Bureau (CFPB) recently published an advisory warning that

The Consumer Financial Protection Bureau (CFPB) recently published an advisory warning that  More than 90% of prospective employers, landlords, insurance companies and banks use background check data as part of their application process. These companies must have a legally permissible purpose to obtain a copy of a consumer’s background report when evaluating the consumer for credit, insurance, housing, or employment decisions. The consumer is entitled to a copy of the background check report used to evaluate his or her application.

More than 90% of prospective employers, landlords, insurance companies and banks use background check data as part of their application process. These companies must have a legally permissible purpose to obtain a copy of a consumer’s background report when evaluating the consumer for credit, insurance, housing, or employment decisions. The consumer is entitled to a copy of the background check report used to evaluate his or her application. Background reports include information such as, employment history, credit information and legal problems. In some cases, social media accounts may show up. The more data listed in a background check could mean a greater possibility for error. As a result, the consumer could be denied a job, housing, insurance or credit. Just one error on a background report can cause significant harm. Procedures for maintaining and dispensing accurate information are critical. Background reports must ensure proper identification of the applicant, plus accurate data related to the applicant. Disclaimers by background reporting companies do not cure permissible violations. Instead, they could violate a person’s privacy, which is strictly prohibited under the FCRA.

Background reports include information such as, employment history, credit information and legal problems. In some cases, social media accounts may show up. The more data listed in a background check could mean a greater possibility for error. As a result, the consumer could be denied a job, housing, insurance or credit. Just one error on a background report can cause significant harm. Procedures for maintaining and dispensing accurate information are critical. Background reports must ensure proper identification of the applicant, plus accurate data related to the applicant. Disclaimers by background reporting companies do not cure permissible violations. Instead, they could violate a person’s privacy, which is strictly prohibited under the FCRA. When a background check is required, the prospective employer or landlord must obtain written permission from the applicant to request a report. A Disclosure Notice and Authorization form must be filled out and signed by the applicant, then submitted to the background check company. Most authorization forms require the applicant’s full name, date of birth, social security number, current zip code, phone number and email address. Screening for some types of employment may require additional information, such as motor vehicle reports, employment verifications or international criminal checks.

When a background check is required, the prospective employer or landlord must obtain written permission from the applicant to request a report. A Disclosure Notice and Authorization form must be filled out and signed by the applicant, then submitted to the background check company. Most authorization forms require the applicant’s full name, date of birth, social security number, current zip code, phone number and email address. Screening for some types of employment may require additional information, such as motor vehicle reports, employment verifications or international criminal checks. Credit reports must be kept accurate.

Credit reports must be kept accurate. The website, annualcreditreport.com, is the quickest way to access reports. By writing to the three main credit bureaus – Transunion, Experian and Equifax — to

The website, annualcreditreport.com, is the quickest way to access reports. By writing to the three main credit bureaus – Transunion, Experian and Equifax — to  After reviewing your credit report for accuracy, if there are errors listed you may need to write to the lender, creditor, collection agency or other type of data furnisher to request updated information on your account. Obtaining verification of your account status from these companies can provide useful evidence when your dispute is investigated by the credit bureau and evaluated for accuracy.

After reviewing your credit report for accuracy, if there are errors listed you may need to write to the lender, creditor, collection agency or other type of data furnisher to request updated information on your account. Obtaining verification of your account status from these companies can provide useful evidence when your dispute is investigated by the credit bureau and evaluated for accuracy. Although the credit bureaus accept disputes online and by phone, consumers must be cautious. These methods of disputing could present problems.

Although the credit bureaus accept disputes online and by phone, consumers must be cautious. These methods of disputing could present problems. Dispute letters should be sent to the credit bureaus by Certified Mail, Return Receipt. Be sure to keep a copy of the dispute letter and all supporting documents enclosed with your letter, along with all mailing receipts from the post office.

Dispute letters should be sent to the credit bureaus by Certified Mail, Return Receipt. Be sure to keep a copy of the dispute letter and all supporting documents enclosed with your letter, along with all mailing receipts from the post office. The Fair Credit Reporting Act

The Fair Credit Reporting Act  Consumer credit is when credit is advanced to a consumer for the purchase of personal or household goods or services. The system for extension of credit allows consumers to borrow money, or incur debt, and to defer repayment of that money over time.

Consumer credit is when credit is advanced to a consumer for the purchase of personal or household goods or services. The system for extension of credit allows consumers to borrow money, or incur debt, and to defer repayment of that money over time. Having

Having  Consumers may explore options to finance the purchase by contacting banks, credit unions and financial institutions. The terms for borrowing money may vary from one lender to another. After submission of a credit application, lenders take steps to evaluate the borrower’s creditworthiness. Typically, a credit application triggers a

Consumers may explore options to finance the purchase by contacting banks, credit unions and financial institutions. The terms for borrowing money may vary from one lender to another. After submission of a credit application, lenders take steps to evaluate the borrower’s creditworthiness. Typically, a credit application triggers a  Borrowers must be prepared for the lender to approve or

Borrowers must be prepared for the lender to approve or  A credit reference is one of the methods lenders and service providers use to determine a borrower’s creditworthiness. Credit references can include your bank, previous landlords, employers, or companies whose bills you’ve paid regularly. Depending on the type of application, it is best to submit the best reference for the situation. Typically, this person or company would improve the borrower’s chances for approval for the type of loan that is sought.

A credit reference is one of the methods lenders and service providers use to determine a borrower’s creditworthiness. Credit references can include your bank, previous landlords, employers, or companies whose bills you’ve paid regularly. Depending on the type of application, it is best to submit the best reference for the situation. Typically, this person or company would improve the borrower’s chances for approval for the type of loan that is sought.  A car purchase is one of the most exciting purchases a consumer makes. But let’s face it, cars are expensive and you have to figure out how to pay for them.

A car purchase is one of the most exciting purchases a consumer makes. But let’s face it, cars are expensive and you have to figure out how to pay for them. Before visiting the dealership, consumers must review their finances and evaluate payment options. Informed buyers allow for making the best car buying decisions. Car salespeople are known to pressure potential buyers in to selecting vehicles from their lot — often ones the consumer may not want or be able to afford.

Before visiting the dealership, consumers must review their finances and evaluate payment options. Informed buyers allow for making the best car buying decisions. Car salespeople are known to pressure potential buyers in to selecting vehicles from their lot — often ones the consumer may not want or be able to afford. the consumer’s credit accounts, including balances and payment history. When reports reflect incorrect information, lenders may deny applications for credit.

the consumer’s credit accounts, including balances and payment history. When reports reflect incorrect information, lenders may deny applications for credit. institutions review the consumer’s credit reports and scores in the process of determining whether to extend credit or not. Various factors are considered in the evaluation process:

institutions review the consumer’s credit reports and scores in the process of determining whether to extend credit or not. Various factors are considered in the evaluation process: Shop for the Financing

Shop for the Financing

In online complaints, Titan Solar has been accused of engaging in predatory marketing and of misrepresenting facts. Sometimes, Titan Solar is accused of not informing the customer that installation is conditioned upon agreeing to a decades-long loan or power purchase agreement, and the contract might be hidden from the consumer. Titan Solar’s finance company partner may also pull your

In online complaints, Titan Solar has been accused of engaging in predatory marketing and of misrepresenting facts. Sometimes, Titan Solar is accused of not informing the customer that installation is conditioned upon agreeing to a decades-long loan or power purchase agreement, and the contract might be hidden from the consumer. Titan Solar’s finance company partner may also pull your  some other legitimate business purpose for pulling your credit. Often, during the process of applying for new credit or utilities, or interviewing with a prospective employer or landlord, there may be a request to access the consumer’s credit file. The consumer must provide written permission for his or her credit file to be accessed.

some other legitimate business purpose for pulling your credit. Often, during the process of applying for new credit or utilities, or interviewing with a prospective employer or landlord, there may be a request to access the consumer’s credit file. The consumer must provide written permission for his or her credit file to be accessed. Lenders evaluate the number of hard inquiries that appear on a consumer’s credit reports during the credit application review process. Although hard inquiries represent one factor in the calculation of credit scores, too many hard inquiries in a short time could impact scores negatively and jeopardize the approval of a new credit application.

Lenders evaluate the number of hard inquiries that appear on a consumer’s credit reports during the credit application review process. Although hard inquiries represent one factor in the calculation of credit scores, too many hard inquiries in a short time could impact scores negatively and jeopardize the approval of a new credit application. Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

Andy Milz is a contributing author to REPOSSESSION, National Consumer Law Center (10th ed. 2022) Carolyn Carter, Andrew Milz, et. al., considered the leading

Flitter Milz was presented with the Equal Justice Award in recognition of support to legal aid programs that allow low-income consumers to seek economic justice.

Flitter Milz was presented with the Equal Justice Award in recognition of support to legal aid programs that allow low-income consumers to seek economic justice. Cary Flitter was honored in May 2022 at the Fête 4 Justice hosted by Legal Aid of Southeastern Pennsylvania for his continued support of their mission to provide free civil legal aid to low-income consumers in Bucks, Chester, Delaware and Montgomery counties which surround Philadelphia, Pennsylvania.

Cary Flitter was honored in May 2022 at the Fête 4 Justice hosted by Legal Aid of Southeastern Pennsylvania for his continued support of their mission to provide free civil legal aid to low-income consumers in Bucks, Chester, Delaware and Montgomery counties which surround Philadelphia, Pennsylvania. Philadelphia Legal Assistance — Jubilee for Justice

Philadelphia Legal Assistance — Jubilee for Justice Flitter Milz represents people in individual and class action lawsuits with legal problems involving consumer credit transactions. Our attorneys evaluate whether a consumer’s rights have been violated — at no cost to the consumer — in matters related to credit reporting accuracy and privacy violations, wrongful vehicle repossessions, abuse from debt collectors, and consumer frauds, such as solar panel sales fraud.

Flitter Milz represents people in individual and class action lawsuits with legal problems involving consumer credit transactions. Our attorneys evaluate whether a consumer’s rights have been violated — at no cost to the consumer — in matters related to credit reporting accuracy and privacy violations, wrongful vehicle repossessions, abuse from debt collectors, and consumer frauds, such as solar panel sales fraud.  The three main national credit bureaus — Trans Union, Equifax, and Experian — have agreed to make changes in the reporting of medical debt. As of July 1, 2022, settled medical debt that would normally remain on credit reports for up to 7 1/2 years should come off the report. As a result, consumers may see an increase in their credit score, a benefit which can open doors to borrowing at more favorable rates for housing, loans and credit cards.

The three main national credit bureaus — Trans Union, Equifax, and Experian — have agreed to make changes in the reporting of medical debt. As of July 1, 2022, settled medical debt that would normally remain on credit reports for up to 7 1/2 years should come off the report. As a result, consumers may see an increase in their credit score, a benefit which can open doors to borrowing at more favorable rates for housing, loans and credit cards. Let’s face it. Most medical debt is incurred unexpectedly. Patients visit doctors or seek medical treatment because they are sick or have had an injury. Due to the high cost of healthcare, many Americans have difficulty paying expensive medical bills to hospitals, physicians, labs and other medical providers.

Let’s face it. Most medical debt is incurred unexpectedly. Patients visit doctors or seek medical treatment because they are sick or have had an injury. Due to the high cost of healthcare, many Americans have difficulty paying expensive medical bills to hospitals, physicians, labs and other medical providers. Unfortunately, unpaid medical debt may be forwarded to a collection agency or law firm collector. Once in collection, negative tradelines appear on credit reports and credit scores may drop. Consumers then begin to feel the effects of a negative credit rating.

Unfortunately, unpaid medical debt may be forwarded to a collection agency or law firm collector. Once in collection, negative tradelines appear on credit reports and credit scores may drop. Consumers then begin to feel the effects of a negative credit rating. Attorney Andy Milz states, “Here at Flitter Milz, PC, we strongly believe medical debt should not be reported at all. Unlike a mortgage, credit card, or car loan, medical debt does not represent a financial choice, but is often a result of an emergency or hardship. And, even for the majority of consumers with some form of health insurance, getting the insurance company to pay the bill in its entirety is always a challenge. Inability to pay medical debts should not weigh down a person’s creditworthiness. Unfortunately, until now, health care providers, medical debt collectors, and the credit bureaus have been allowed to report this negative information.”

Attorney Andy Milz states, “Here at Flitter Milz, PC, we strongly believe medical debt should not be reported at all. Unlike a mortgage, credit card, or car loan, medical debt does not represent a financial choice, but is often a result of an emergency or hardship. And, even for the majority of consumers with some form of health insurance, getting the insurance company to pay the bill in its entirety is always a challenge. Inability to pay medical debts should not weigh down a person’s creditworthiness. Unfortunately, until now, health care providers, medical debt collectors, and the credit bureaus have been allowed to report this negative information.”