Buying a car is costly. Most people finance the purchase of a vehicle by taking out a loan. The agreement states terms for regular monthly payments to be made until the debt is satisfied. If the borrower defaults on payments, the lender has the right to repossess the vehicle.

Auto Finance Law & Bankruptcy

However, there is a complicated intersection between auto finance law and bankruptcy. Before taking any action, borrowers must understand the implications of bankruptcy and be able to determine the most prudent steps to take before and after a vehicle has been repossessed. In general, merely having your car or truck repossessed is not enough to warrant filing for bankruptcy. Let’s try to simplify it.

However, there is a complicated intersection between auto finance law and bankruptcy. Before taking any action, borrowers must understand the implications of bankruptcy and be able to determine the most prudent steps to take before and after a vehicle has been repossessed. In general, merely having your car or truck repossessed is not enough to warrant filing for bankruptcy. Let’s try to simplify it.

Repossession = Bankruptcy? Maybe, maybe not.

- Filing a bankruptcy can stop a repossession from going forward.

When a consumer bankruptcy is initiated, the debtor protections include an “automatic stay.” This means that your creditors are prohibited from taking almost all actions to collect a debt. This automatic provision can be a powerful way to prevent repossession of the car, but only temporarily. - The automatic stay can last weeks or years.

The stay begins automatically upon filing and lasts only as long as the Court allows it to, which can be anywhere from weeks to several years, depending on the type of bankruptcy you choose to file. However, if you filed an earlier bankruptcy within a year of the new bankruptcy case, the automatic stay will terminate within 30 days. The judge also has the choice of extending or shortening the time period in certain circumstances. Even if you file for bankruptcy, to keep your financed car you will have to resume a car loan repayment schedule. - Filing a bankruptcy after the repossession will not necessarily get you the car back.

If the lender already repossessed your car, then the bankruptcy does not necessarily require the lender to return the car. If the car was already sold by the lender by the time you file bankruptcy, then it is already too late. However, if the sale has not gone forward, a bankruptcy may stop the lender from selling the car, and perhaps you can get it back by agreeing to ongoing monthly payments. This is something to discuss with your bankruptcy attorney. - If you file bankruptcy, you might have to eventually give up the car, but not always.

The point of bankruptcy is to help people in debt have a fresh start. Because of this, there are certain state and federal exemptions you can claim to prevent the car from being lost to the bankruptcy. For example, under the federal rules, you can claim $4,450 in a motor vehicle as exempt. This means that if you owe less than that amount on the car, you’ll be able to keep it. If you owe more, then the trustee may sell your car, pay you $4,450 for the exemption, and distribute the rest among your creditors — unless you make a showing of need before the bankruptcy court, something your bankruptcy lawyer can help with. - Even if you file bankruptcy, you will likely need to continue making car payments throughout the bankruptcy if you want to keep the car.

This is because the lender has “lien” or “security interest” in the car, which is still recognized in the bankruptcy. So, if you don’t pay as agreed, or if you default on the car loan in some other way (g. failing to maintain insurance) then the lender may still be able to repossess the car. Practically speaking, you’ll need to keep paying on the car loan if you want to keep the car through your bankruptcy.Borrowers have rights when facing repossession

If your car was already repossessed, you have other rights as a consumer borrower, separate from any bankruptcy proceeding. Bankruptcy is only one tool or avenue if your car or truck has been repossessed – and it might, or might not, be right for your specific situation. Consult with an experienced consumer lawyer to understand your options outside of a bankruptcy.

If your car was already repossessed, you have other rights as a consumer borrower, separate from any bankruptcy proceeding. Bankruptcy is only one tool or avenue if your car or truck has been repossessed – and it might, or might not, be right for your specific situation. Consult with an experienced consumer lawyer to understand your options outside of a bankruptcy.

Seek advice from an Experienced Consumer Lawyer

If you’re concerned that the lender my repossess your vehicle, or perhaps thinking of filing bankruptcy to get your car back after repossession, contact Flitter Milz for a no cost case evaluation. Our attorneys are knowledgeable of consumer laws that protect borrowers from wrongful repossessions.

If you’re concerned that the lender my repossess your vehicle, or perhaps thinking of filing bankruptcy to get your car back after repossession, contact Flitter Milz for a no cost case evaluation. Our attorneys are knowledgeable of consumer laws that protect borrowers from wrongful repossessions.

Pictured l-r: Attorneys Cary Flitter and Andy Milz.

Similar to purchasing other items for the home, when considering solar panels, homeowners must shop around, get quotes, and investigate solar panel companies to compare one offer from another. There are a wide variety of products on the market with varying levels of efficiency, durability, reliability, output and design. As well, there are a number of solar companies and installers — some are better than others. Check the company’s reputation to see if complaints been filed against them with the Federal Trade Commission, State Attorney General, or Better Business Bureau? Also, searching court dockets for lawsuits that have been filed against solar panel companies or their finance companies may provide insight to issues that other consumer’s have faced involving solar transactions.

Similar to purchasing other items for the home, when considering solar panels, homeowners must shop around, get quotes, and investigate solar panel companies to compare one offer from another. There are a wide variety of products on the market with varying levels of efficiency, durability, reliability, output and design. As well, there are a number of solar companies and installers — some are better than others. Check the company’s reputation to see if complaints been filed against them with the Federal Trade Commission, State Attorney General, or Better Business Bureau? Also, searching court dockets for lawsuits that have been filed against solar panel companies or their finance companies may provide insight to issues that other consumer’s have faced involving solar transactions. of the benefits of solar power, the consumer is presented an iPad or tablet to sign, believing their signature gives the salesman permission to evaluate the property for panels. However, the signature, or initials, on an iPad may authorize the solar company, without the consumer’s knowledge, to:

of the benefits of solar power, the consumer is presented an iPad or tablet to sign, believing their signature gives the salesman permission to evaluate the property for panels. However, the signature, or initials, on an iPad may authorize the solar company, without the consumer’s knowledge, to: Solar loans work like other home improvement loans. The loan is taken out through a finance company with monthly payments made to the lender for the purchase of the system. Just like researching the solar company, homeowners must research the best way to finance the solar power system. There are several companies, such as Goodleap, Mosaic, or Sunlight Financial, that offer loans for solar panels. But ask yourself, which one offers the best terms for me?

Solar loans work like other home improvement loans. The loan is taken out through a finance company with monthly payments made to the lender for the purchase of the system. Just like researching the solar company, homeowners must research the best way to finance the solar power system. There are several companies, such as Goodleap, Mosaic, or Sunlight Financial, that offer loans for solar panels. But ask yourself, which one offers the best terms for me? to-door sales companies who sometimes entice people to sign up for “free” solar panels. Hundreds of consumers have complained about Loanpal/Goodleap’s business practices to the Better Business Bureau. The Better Business Bureau has rated Loanpal an “F.” From customer reviews, Loanpal received only one out of five stars. In fact, some consumers complain that they never saw or signed a contract. When faced with accusations that the solar panel salesperson engaged in fraud — such as signing up a consumer for a loan without their knowledge or consent — Goodleap has attempted to distance itself from the solar panel company.

to-door sales companies who sometimes entice people to sign up for “free” solar panels. Hundreds of consumers have complained about Loanpal/Goodleap’s business practices to the Better Business Bureau. The Better Business Bureau has rated Loanpal an “F.” From customer reviews, Loanpal received only one out of five stars. In fact, some consumers complain that they never saw or signed a contract. When faced with accusations that the solar panel salesperson engaged in fraud — such as signing up a consumer for a loan without their knowledge or consent — Goodleap has attempted to distance itself from the solar panel company. Flitter Milz is a nationally recognized consumer protection law firm that evaluates solar panel sales matters for potential violation of the consumer laws involving fraud, such as forged contracts, identity theft and credit reporting privacy violations.

Flitter Milz is a nationally recognized consumer protection law firm that evaluates solar panel sales matters for potential violation of the consumer laws involving fraud, such as forged contracts, identity theft and credit reporting privacy violations.

Read more below:

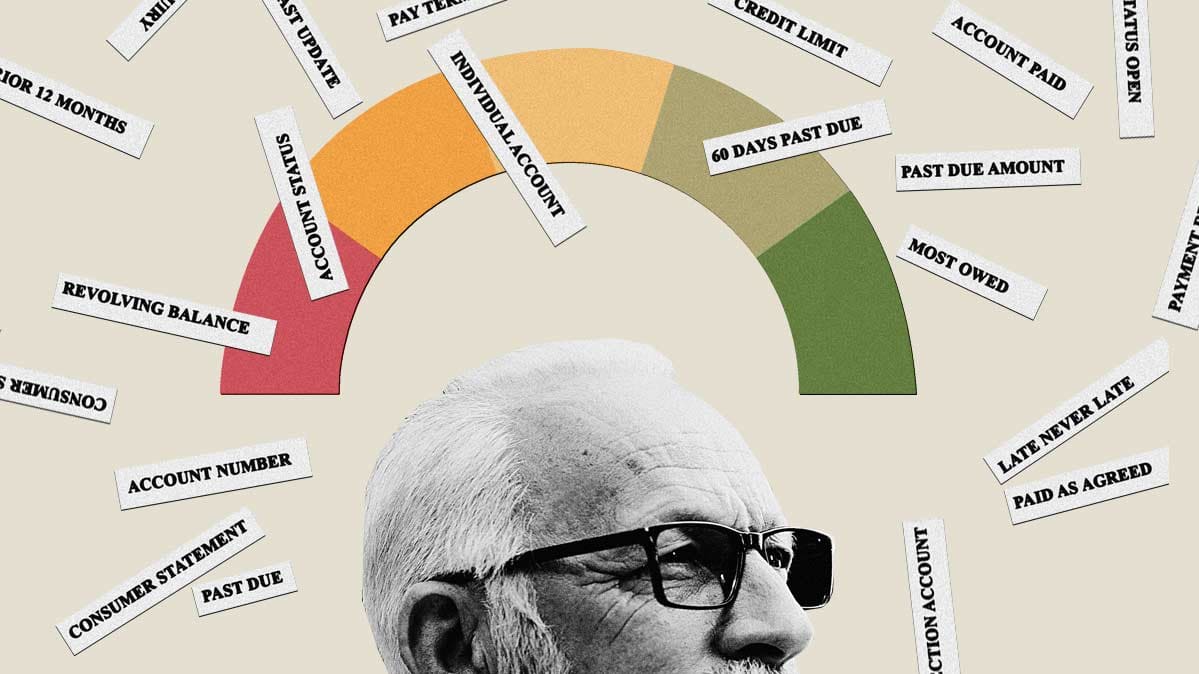

Read more below: There are a variety of reasons why credit files get mixed. With the amount of information handled by creditors and the credit bureaus, mistakes are bound to happen. For example, information from an application may be keyed into a file incorrectly. Digits on a social security number may be transposed, or a name misspelled from an application. Those errors can pass from the original creditor through to the credit bureau. Or, the credit bureau mistakenly may combine credit files of two or more different consumers into one file. Unfortunately, the errors may not be discovered until the consumer reviews his or her report…usually after applying for new credit.

There are a variety of reasons why credit files get mixed. With the amount of information handled by creditors and the credit bureaus, mistakes are bound to happen. For example, information from an application may be keyed into a file incorrectly. Digits on a social security number may be transposed, or a name misspelled from an application. Those errors can pass from the original creditor through to the credit bureau. Or, the credit bureau mistakenly may combine credit files of two or more different consumers into one file. Unfortunately, the errors may not be discovered until the consumer reviews his or her report…usually after applying for new credit. If you believe someone else’s information has been mixed with or merged onto your credit file, a

If you believe someone else’s information has been mixed with or merged onto your credit file, a  The reporting bureau has 30 days to respond to your written dispute. If errors are not corrected, you may need to send a second dispute to that bureau, and possibly provide additional documentation. Or, you may need to write to the underlying creditor, explain the problem and request corrected information be sent to the reporting bureau.

The reporting bureau has 30 days to respond to your written dispute. If errors are not corrected, you may need to send a second dispute to that bureau, and possibly provide additional documentation. Or, you may need to write to the underlying creditor, explain the problem and request corrected information be sent to the reporting bureau. The

The  If someone else’s debt or a stranger’s account is on your credit report, Flitter Milz can help. Whether your credit file has been mixed or mis-merged with a family member, someone with a similar name, or a total stranger, your consumer rights may have been violated.

If someone else’s debt or a stranger’s account is on your credit report, Flitter Milz can help. Whether your credit file has been mixed or mis-merged with a family member, someone with a similar name, or a total stranger, your consumer rights may have been violated.  Understand credit scores and credit reports

Understand credit scores and credit reports What is a credit score?

What is a credit score? credit and obtain copies of his or her credit reports and credit scores.

credit and obtain copies of his or her credit reports and credit scores. Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you.  Do you have errors on your credit reports? Problems getting credit?

Do you have errors on your credit reports? Problems getting credit? Lenders are not required to notify the borrower in advance of an auto repossession. However, after a vehicle has been taken, the lender must send a letter to the borrower outlining terms to get the vehicle back — whether the lender is a bank, such as Well Fargo or Bank of America, a credit union, such as Pennsylvania State Employees Credit Union or Erie Federal Credit Union, or a financial institution such as Driveway Finance or PA Auto Credit. The repossession letter, often called a

Lenders are not required to notify the borrower in advance of an auto repossession. However, after a vehicle has been taken, the lender must send a letter to the borrower outlining terms to get the vehicle back — whether the lender is a bank, such as Well Fargo or Bank of America, a credit union, such as Pennsylvania State Employees Credit Union or Erie Federal Credit Union, or a financial institution such as Driveway Finance or PA Auto Credit. The repossession letter, often called a  After the lender has made the decision to repossess a vehicle, arrangements are made with a repo agent who will locate the vehicle and take it, often without warning. In advance of the repossession, the repo agent must inform the local police department of their intent to seize the vehicle. The repo agent may come with a tow truck to the borrower’s home or place of employment. Or, they may track the vehicle

After the lender has made the decision to repossess a vehicle, arrangements are made with a repo agent who will locate the vehicle and take it, often without warning. In advance of the repossession, the repo agent must inform the local police department of their intent to seize the vehicle. The repo agent may come with a tow truck to the borrower’s home or place of employment. Or, they may track the vehicle  finding it at another location, such as at a shopping mall, doctor’s office, or the address of a family member or friend. Sometimes at the time of purchase, the dealership may have installed a GPS tracking device or a remote control car disabler. The repo agent may use these devices to track vehicles that have been assigned for repossession.

finding it at another location, such as at a shopping mall, doctor’s office, or the address of a family member or friend. Sometimes at the time of purchase, the dealership may have installed a GPS tracking device or a remote control car disabler. The repo agent may use these devices to track vehicles that have been assigned for repossession. In Pennsylvania, a repossession agent has to be licensed with the Department of Banking and Securities of the Commonwealth and may be hired by a bank, credit union or finance company to repossess cars, trucks motorcycles, RVs, powersport vehicles, boats or airplanes. If a vehicle is missing, the borrower should make calls to the local police and the lender to confirm it was not stolen.

In Pennsylvania, a repossession agent has to be licensed with the Department of Banking and Securities of the Commonwealth and may be hired by a bank, credit union or finance company to repossess cars, trucks motorcycles, RVs, powersport vehicles, boats or airplanes. If a vehicle is missing, the borrower should make calls to the local police and the lender to confirm it was not stolen.

Before contacting a solar sales company, the homeowner should take time to evaluate whether adding solar panels to the home would provide enough financial benefit, plus meet the energy needs of the household. Factors for consideration are: house size, roof — condition and dimensions, climate zone, community regulations, local electricity rates and government incentives. As well, the homeowner may contemplate the following:

Before contacting a solar sales company, the homeowner should take time to evaluate whether adding solar panels to the home would provide enough financial benefit, plus meet the energy needs of the household. Factors for consideration are: house size, roof — condition and dimensions, climate zone, community regulations, local electricity rates and government incentives. As well, the homeowner may contemplate the following: Determine ways that may reduce the current expense such as, changing light bulbs; installing dimmers; fixing a leaking faucet; repairing ductwork. Understand your cost of energy and how much you might save by changing to solar.

Determine ways that may reduce the current expense such as, changing light bulbs; installing dimmers; fixing a leaking faucet; repairing ductwork. Understand your cost of energy and how much you might save by changing to solar. Evaluate the sun’s path during daylight hours. How many hours of the day does the roof get sunlight? Calculate the number of hours that your roof is shaded. Does the sun/shade ratio change from season-to-season? Would solar panels provide the same benefit throughout the year?

Evaluate the sun’s path during daylight hours. How many hours of the day does the roof get sunlight? Calculate the number of hours that your roof is shaded. Does the sun/shade ratio change from season-to-season? Would solar panels provide the same benefit throughout the year? Does the roof and/or shingles require repair or replacement before installation of panels? Will the roof handle the weight of solar panels? Shall I contact an independent roofer to evaluate the roof’s condition?

Does the roof and/or shingles require repair or replacement before installation of panels? Will the roof handle the weight of solar panels? Shall I contact an independent roofer to evaluate the roof’s condition? Review landscaping around the property for sun exposure to the roof. Will panels get enough sunlight to perform at maximum efficiency? Consult with an arborist to estimate tree growth over a 25 year period and the impact of sunlight over the seasons. Will trees require removal or transplant?

Review landscaping around the property for sun exposure to the roof. Will panels get enough sunlight to perform at maximum efficiency? Consult with an arborist to estimate tree growth over a 25 year period and the impact of sunlight over the seasons. Will trees require removal or transplant? Before entering an agreement for a solar power system, whether as an initial purchase, refinancing an existing contract, or purchasing a home with an existing system, you, the consumer, must obtain a copy of the solar panel contract. Take time to review the terms of the agreement. If you need clarification, consult with a real estate agent or real estate attorney for explanation of your legal and financial obligation. Determine whether this agreement is right for you by evaluating:

Before entering an agreement for a solar power system, whether as an initial purchase, refinancing an existing contract, or purchasing a home with an existing system, you, the consumer, must obtain a copy of the solar panel contract. Take time to review the terms of the agreement. If you need clarification, consult with a real estate agent or real estate attorney for explanation of your legal and financial obligation. Determine whether this agreement is right for you by evaluating:

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle.

While most repossessions are initiated by the lender, sometimes it’s the borrower that decides to voluntarily surrender his or her vehicle. Whether or not, after a repossession it’s important for the borrower to understand his or her financial responsibility to satisfy the loan once the lender has taken possession of the vehicle. can’t meet the terms agreed upon in their auto loan agreement.

can’t meet the terms agreed upon in their auto loan agreement. First, after taking back the vehicle, the lender will send a repossession notice, or

First, after taking back the vehicle, the lender will send a repossession notice, or

The hard facts about Repossession.

The hard facts about Repossession. When the borrower

When the borrower  Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to

Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to  Send Effective Disputes

Send Effective Disputes

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit. Consumers are entitled to

Consumers are entitled to  If you notice errors on your credit reports, you must

If you notice errors on your credit reports, you must