Uncle Sam Contracts Private Collectors to Collect Unpaid Taxes

The federal government has contracted out the collection of unpaid income tax with four private debt collection agencies. These agencies are CBE Group, ConServe, Performant, and Pioneer Credit Recovery.

Beginning April 2017, the private collection firms will contact taxpayers with overdue federal tax bills. At first, collection letters will be sent, stating the account was transferred by the IRS to the collector. Then calls will follow.

Beware of Aggressive Collectors

The collectors have an incentive to collect. They’ll receive 25% of every dollar collected.

Although the collectors are still required to follow the Fair Debt Collection Practices Act and respect taxpayer rights, vulnerable taxpayers could be pressured by aggressive collectors to pay more than they can afford.

The IRS also offers various taxpayer programs to eligible taxpayers. Be sure to inquire about your eligibility for these programs.

Where to Send Payments

The government’s collectors will target taxpayers owing less than $50,000 and move up from there. They may discuss payment options with taxpayers, but all payments are to be sent, either electronically or by check, to the IRS or U.S. Treasury. Payments are not to be sent to the private debt collection agency.

If you feel that you are being harassed, or that the claimed debt isn’t accurate, file a complaint with:

Consumer Financial Protection Bureau: 1-855-411-2372

U.S. Treasury, Inspector General for Tax Administration: 1-800-366-4484

Questions about Debt Collection?

Flitter Milz is a nationally recognized consumer protection law firm that represents victims of abusive collection tactics. Contact Us if you have questions concerning contact from debt collectors. There is no cost for the consultation.

A key aspect of financial wellness is to

A key aspect of financial wellness is to  It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time.

It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time.

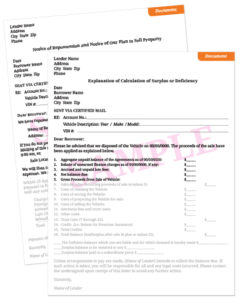

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken.

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken. Notice of Intent to Sell Property

Notice of Intent to Sell Property