Your credit affects many aspects of your life, perhaps even more than you realize. Consumers with significant negative marks on their credit report and a low credit score will likely have more difficulty securing a new line of credit, renting an apartment, and avoiding high interest rates on loans and credit cards.

Poor credit also makes it difficult, and sometimes impossible, to secure an auto loan. If you find yourself in this position and are trying to purchase a new vehicle, you may be tempted by dealerships that advertise, “No credit, no problem!” These dealerships finance loans “in-house” and often carry extremely high interest rates when compared to loans from banks, credit unions, and other lenders.

Shop Around for an Auto Loan

Before agreeing to a loan with one of these dealerships, be sure to shop around and see if there is a bank, credit union or other lender who is willing to loan to you. An auto loan with high interest rates, like those that typically come from buy here – pay here dealerships, may not be worth it; the cost of the loan could outweigh the benefit of purchasing the vehicle. Learn more about steps to take to secure an auto loan.

Before agreeing to a loan with one of these dealerships, be sure to shop around and see if there is a bank, credit union or other lender who is willing to loan to you. An auto loan with high interest rates, like those that typically come from buy here – pay here dealerships, may not be worth it; the cost of the loan could outweigh the benefit of purchasing the vehicle. Learn more about steps to take to secure an auto loan.

Obtain Current Credit Reports

Before visiting the car dealership, it’s important to check your credit reports. If you discover errors on your report, address them before seeking new credit. You do not want to risk denial for a loan, and possibly a drop in credit score, because of these errors.

Before visiting the car dealership, it’s important to check your credit reports. If you discover errors on your report, address them before seeking new credit. You do not want to risk denial for a loan, and possibly a drop in credit score, because of these errors.

Send your written dispute to the credit bureau and the creditor. Request the listing on your report be corrected. Once your report is accurate, shop for the loan that offers you the best terms.

Seek Legal Advice

Flitter Milz is a consumer protection law firm that represents people that defaulted on auto loan payments and had a vehicle repossessed. Contact Us for a FREE legal evaluation of whether the lender or repo agent violated the consumer protection laws.

Flitter Milz is a consumer protection law firm that represents people that defaulted on auto loan payments and had a vehicle repossessed. Contact Us for a FREE legal evaluation of whether the lender or repo agent violated the consumer protection laws.

When you’re in the market to purchase a new vehicle and need to

When you’re in the market to purchase a new vehicle and need to  There are a number of factors that will affect your auto loan agreement, but the most important is your credit history. Before you start shopping for interest rates, check your

There are a number of factors that will affect your auto loan agreement, but the most important is your credit history. Before you start shopping for interest rates, check your  Flitter Milz is a consumer protection law firm that represents borrowers that have defaulted on their auto loan. Whether payments have been missed or not, the lender must follow the law.

Flitter Milz is a consumer protection law firm that represents borrowers that have defaulted on their auto loan. Whether payments have been missed or not, the lender must follow the law.  When friends or relatives can’t secure a loan on their own, they may ask you to help by co-signing. A co-signer is often required for someone to secure a loan if they have poor

When friends or relatives can’t secure a loan on their own, they may ask you to help by co-signing. A co-signer is often required for someone to secure a loan if they have poor  Just when you think you’re getting your finances in order and want to apply for a new line of credit, a

Just when you think you’re getting your finances in order and want to apply for a new line of credit, a  Vehicle repossessions are worrisome and stressful enough, but what happens when the lender files a lawsuit against you after the repossession? Learn about what a deficiency lawsuit is, and what you should do if you’re being sued.

Vehicle repossessions are worrisome and stressful enough, but what happens when the lender files a lawsuit against you after the repossession? Learn about what a deficiency lawsuit is, and what you should do if you’re being sued. A qualified consumer rights attorney can evaluate all collection contact for compliance with the Fair Debt Collection Practices Act. If the collector’s tactics have violated the law, you can sue the collector, even though the deficient balance may be owed.

A qualified consumer rights attorney can evaluate all collection contact for compliance with the Fair Debt Collection Practices Act. If the collector’s tactics have violated the law, you can sue the collector, even though the deficient balance may be owed. A qualified consumer rights attorney can evaluate all collection contact for compliance with

A qualified consumer rights attorney can evaluate all collection contact for compliance with

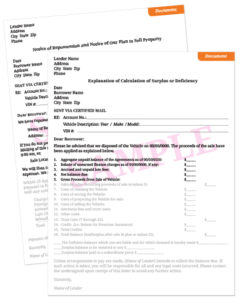

After the repossession, the lender is required to provide certain notices to the consumer. First, a

After the repossession, the lender is required to provide certain notices to the consumer. First, a  You leave your house in the morning and to drive to work. Suddenly, you realize that your car is no longer in the parking lot.

You leave your house in the morning and to drive to work. Suddenly, you realize that your car is no longer in the parking lot. A key aspect of financial wellness is to

A key aspect of financial wellness is to  It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time.

It’s important to stay up to date on all payments. Be sure to pay in full and on time each month. Remember, if you are late or miss a couple payments there may be additional interest or late fees owed to bring your account current. Until these fees are paid, your account is still overdue, even if you pay your next payment in full and on time. A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken.

A car repossession can make you feel powerless, as if you don’t have any rights regarding your property. The consequences of a repossession are difficult enough without having to worry about the personal items that were in your vehicle at the time it was taken. Notice of Intent to Sell Property

Notice of Intent to Sell Property