Understand credit scores and credit reports

Understand credit scores and credit reports

Credit is part of your financial power. It plays a crucial role in enabling us to get the things we may need or want, such as homes, vehicles or educations. However, many consumers don’t take an active role in managing and monitoring their credit scores or credit files. There is a common misconception that your “credit score” is your credit report. It is important to understand the difference.

What is a credit score?

What is a credit score?

A credit score is a number that predicts how likely you are to pay back a loan on time. Information that appears on your credit report is used in a scoring model, which is a mathematical formula, to create the score. Depending on the specific data used to calculate a score, the actual credit score number can vary from one scoring model to another. Most credit scores range from 300 – 850. Higher scores make it easier to qualify for a loan and may result in better terms, such as interest rates and length of the loan.

Seeking Credit

When consumers seek credit, whether it be for a mortgage, auto loan, credit card, or another type of credit product, the lender will request access to the consumer’s  credit and obtain copies of his or her credit reports and credit scores.

credit and obtain copies of his or her credit reports and credit scores.

This information will assist the lender in determining whether to extend credit, and if so, the interest rate on the loan or credit card, and the credit limit.

Here are some guidelines that may help you to get and keep a good credit score

- Pay your loans in full and on time.

- Keep credit balances low in relation to the full credit limit

- Develop good payment history over time

- Only apply for the credit you need

- Review your credit reports regularly

What is a Credit Report?

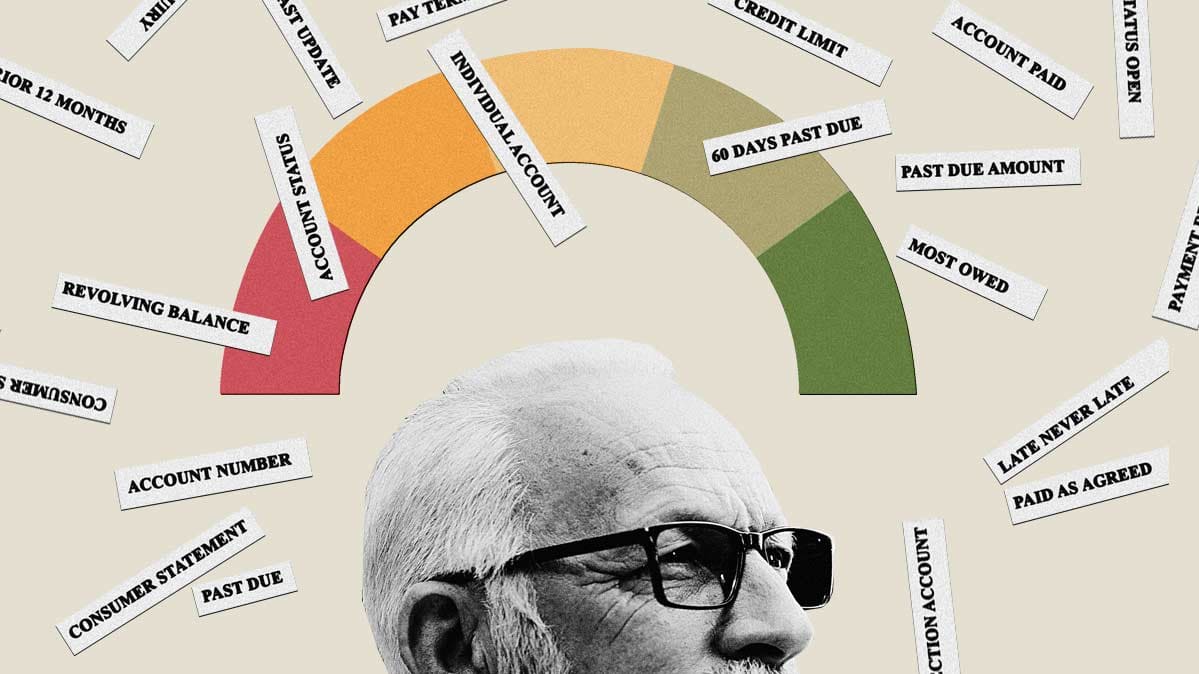

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you. Shall I give you a job offer? Rent you an apartment?

Transunion, Experian and Equifax are the three main credit reporting bureaus. These bureaus provide credit reports which list specific information about a consumer’s credit activity and payment history. Lenders use these reports to help determine whether to extend credit or not. As well, other businesses such as insurance companies and utilities, or prospective employers and landlords, may request access to a consumer’s report for use in making decisions about you. Shall I give you a job offer? Rent you an apartment?

Many people use apps, such as CreditKarma or Credit Sesame, to get a sense of where their credit stands. But these apps do not show your credit report. Instead, they give you only a superficial snapshot of the status of your accounts. They may not show the most up-to-date information about your credit file, which may reflect inaccurately reported missed payments from years ago. The only way you can see the most current information on your credit file is to obtain your credit report from one of the three main bureaus – Transunion, Experian and Equifax.

What type of information is on a Credit Report?

The type of information listed on credit reports can include:

Personal information:

Your name and name changes, current and former addresses, birth date, social security number and phone numbers.

Credit Accounts:

Name of creditor & account type, balance, payment history, credit limit &

date opened/closed.

Collection Accounts:

Credit accounts that have been assigned to a collection agency.

Public Records:

Liens, Foreclosures, Bankruptcies, Civil suits and Judgments

Hard Pull Inquiries:

Lenders that access a consumer’s credit file in the process of extending new credit.

Soft Pull Inquiries:

Businesses access consumer files for the purpose of extending a new

credit opportunity or service.

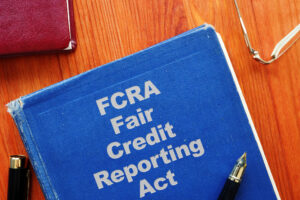

Check your credit reports for accuracy

Credit reports should be reviewed regularly for accuracy. When incorrect information appears on a credit report, the consumer must send a written dispute to the credit bureau. The dispute letter must clearly state the error that appears on the report and include documents that support the claim for correction. The bureaus have 30 days to respond in writing to the dispute. If the error is not corrected, the consumer may need to seek counsel from a qualified consumer protection lawyer.

How to Obtain a Credit Report?

Send a written request to the credit bureau

Consumers may obtain credit reports by writing to Transunion, Experian and Equifax. Your letter should include two forms of identification, such as a current driver’s license and utility bill. It may take about two weeks to receive your report through the mail. Click here for a template letter.

Request your report online:

During the COVID-19 pandemic, Transunion, Experian and Equifax are offering free weekly online credit reports through annualcreditreport.com, a website authorized under federal law that allows you to request free reports from each credit reporting agency every 12 months.

Seek Legal Help from Qualified Consumer Lawyers

Do you have errors on your credit reports? Problems getting credit?

Do you have errors on your credit reports? Problems getting credit?

Flitter Milz is a nationally recognized consumer protection law firm that evaluates matters involving credit reporting accuracy and privacy.

Contact us for a no cost legal evaluation of whether your consumer rights have been violated. Pictured: Cary Flitter (center), Andy Milz (left), Jody López-Jacobs (right)

The hard facts about Repossession.

The hard facts about Repossession. When the borrower

When the borrower  Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to

Whether or not the borrower defaulted on the terms of the auto loan, State and Federal laws govern how lenders and repo agents are to  Send Effective Disputes

Send Effective Disputes Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters of wrongful repossessions and credit reporting accuracy and privacy disputes. When errors remain on credit reports after a dispute,

Flitter Milz is a nationally recognized consumer protection law firm that represents consumers in matters of wrongful repossessions and credit reporting accuracy and privacy disputes. When errors remain on credit reports after a dispute,

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit.

Attorney Andy Milz, cautions consumers that COVID-19-related payment deferrals aren’t the only problem contributing to credit reporting errors and drops in credit scores since the pandemic. He states, in this recent Consumer Reports article, that other common credit reporting errors, such as accounts or loans that have been paid off but still appear as unpaid, individual loans reported multiple times, or debt that’s listed as in collections but has been paid off, can pose hurdles, too, if you need a loan or line of credit. Consumers are entitled to

Consumers are entitled to  If you notice errors on your credit reports, you must

If you notice errors on your credit reports, you must

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature.

An individual or business may request access to a consumer’s credit file, but they must obtain written permission from the consumer. Often, during the process of applying for credit, interviewing with a prospective employer or landlord, or applying for utilities, there may be a request to access the consumer’s credit file. Many times the credit application will serve as written permission. Other times, a specific document will be presented to the consumer for his or her signature. Consumers must

Consumers must

Being asked to co-sign a loan for a family member or close friend is a larger responsibility than most people realize. When you co-sign a loan, such as an auto loan, you and your credit are on the hook if that relative or friend decides to stop making payments on the loan. In other words, by co-signing, you are a co-borrower and must accept responsibility of terms stated in the loan agreement.

Being asked to co-sign a loan for a family member or close friend is a larger responsibility than most people realize. When you co-sign a loan, such as an auto loan, you and your credit are on the hook if that relative or friend decides to stop making payments on the loan. In other words, by co-signing, you are a co-borrower and must accept responsibility of terms stated in the loan agreement. Once the vehicle is sold, the lender may assign collection of the deficient balance to a debt collector or law firm collector. If the loan balance is not paid, the lender could choose to

Once the vehicle is sold, the lender may assign collection of the deficient balance to a debt collector or law firm collector. If the loan balance is not paid, the lender could choose to  Co-signing a loan should not be taken casually. The co-signer must consider whether or not credit may be needed for him or herself. If a co-signer has too much

Co-signing a loan should not be taken casually. The co-signer must consider whether or not credit may be needed for him or herself. If a co-signer has too much  individual the money for the purchase. In other words, you lend the individual the money and they pay you back in installments over time, or whatever agreement the two of you come up with.

individual the money for the purchase. In other words, you lend the individual the money and they pay you back in installments over time, or whatever agreement the two of you come up with.

J

J

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year.

2. Obtain Current Credit Reports. Transunion, Experian and Equifax are the three main credit reporting agencies. Consumers are entitled to receive one free credit report from each bureau every year. Sometimes, consumers choose to enroll in a credit monitoring service which enables review of credit reports on a regular basis throughout the year. 4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should

4. If Inaccurate…Dispute! After obtaining your credit report, if there are errors, you should  One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter.

One Dispute Letter Per Error. If you find multiple errors on a credit report, dispute them individually with the bureau. Enclose a copy of the credit report with the error highlighted and your supporting documents. The credit bureaus then have 30 days to respond to your dispute letter. The Fair Credit Reporting Act

The Fair Credit Reporting Act  Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

Flitter Milz, P.C. represents people in consumer credit matters related to credit reporting accuracy and privacy, abusive debt collection contact and vehicle repossessions which stem from a pending divorce or separation.

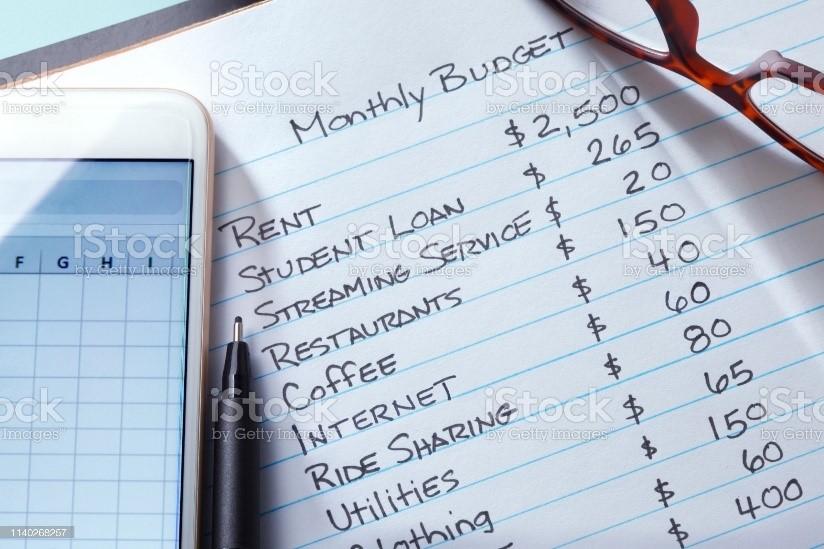

Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future.

Crafting a household budget is not only necessary to help evaluate spending patterns and measure income versus expenditures, but it also helps to ensure a secure financial future. If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense.

If you know how much money is coming in versus going out each month, it becomes less likely that you’ll overspend to the point where payments are skipped or missed. Create the budget that you can stick to with a payment schedule that you can meet. When you stay in charge of your finances, you decide when it’s time to make a new purchase, whether it be for a home, education, a new vehicle, or another personal expense. Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,

Flitter Milz is a nationally recognized consumer protection law firm that represents victims with consumer credit problems, such as credit reporting accuracy and privacy issues, abusive debt collection tactics, wrongful vehicle repossession, which stem from over-spending. If you have errors on your credit reports, have received contact from debt collectors, or your auto lender has repossessed your vehicle,  The holiday shopping season is, under normal circumstances, a big stressor on the wallet. But this year proposes to be even more difficult than in years past, given that the global COVID-19 pandemic has led to massive job losses and financial hardships for people far and wide. Although the federal

The holiday shopping season is, under normal circumstances, a big stressor on the wallet. But this year proposes to be even more difficult than in years past, given that the global COVID-19 pandemic has led to massive job losses and financial hardships for people far and wide. Although the federal  The danger in over-spending comes when that monthly bill is due, and you are still unable to come up with the cash to pay it off. Not paying

The danger in over-spending comes when that monthly bill is due, and you are still unable to come up with the cash to pay it off. Not paying  Using a credit card makes it easy to over-spend, especially during the holidays. The freedom of making purchases with a credit card today, could make it difficult to pay the bill the following month if purchases get out of hand.

Using a credit card makes it easy to over-spend, especially during the holidays. The freedom of making purchases with a credit card today, could make it difficult to pay the bill the following month if purchases get out of hand. Credit reports

Credit reports Flitter Milz is a nationally recognized consumer protection law firm that represents people with credit reporting accuracy and privacy issues, contact from abusive debt collectors and wrongful repossession. If you are someone who has suffered a hardship during the pandemic and feel as though your consumer rights have been violated by the credit bureaus, a lender or debt collector,

Flitter Milz is a nationally recognized consumer protection law firm that represents people with credit reporting accuracy and privacy issues, contact from abusive debt collectors and wrongful repossession. If you are someone who has suffered a hardship during the pandemic and feel as though your consumer rights have been violated by the credit bureaus, a lender or debt collector,